|

Croker-Rhyne Co., Inc. |

|

Main Page |

Philosophy | Current

Recommendations |

Newsletter Archives Contact Us

|

|

|

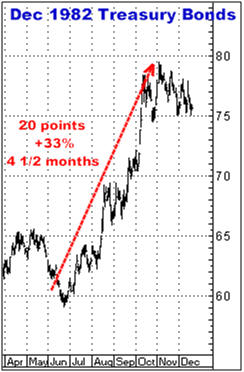

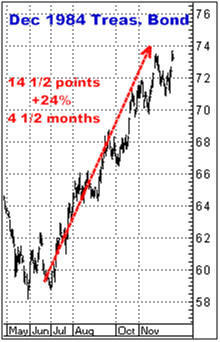

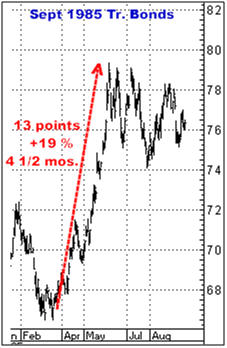

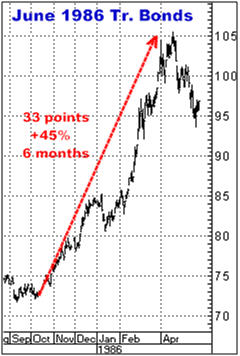

January 23, 2014 We are still Buying Treasury Bonds Looking for, minimally, 12-14 points from here I remember it like it was yesterday… I actually formulated my first opinion in the interest rate markets in the fall of 1981 when the then-significant “Prime Rate” hit 20.5% and the whole economic world was screaming, “Prime headed for 30 per cent! Rates HAVE to go higher!” (supposedly to kill inflation). As a rookie broker, and knowing I knew nothing, even so, I rather simplemindedly arrived at the conclusion a 30 per cent Prime Rate was not possible, nor for that matter could the system even survive if rates stayed at the then current 20%. I still remember my two cent analysis based on nothing more than, “The capitalist equation is built on the idea of 25% labor, 25% cost of materials, 25% overhead and 25% profit. There is no room in this equation for the cost of money being 20%, or even anything close to it”. And with this in mind, I made my very first interest rate recommendation, that being a trade based on the idea, “Rates have to go lower…NOT higher”, which as already noted, was 100% in the opposite direction of what 99% of the supposedly expert opinion was at the time…And my instincts were right. Rates couldn’t have gone any higher…and they didn’t. I don’t throw this out there to crow about some trade I made 33 years ago (I’ve had more than my share of losers since then). It’s just a little reminder that my concept of Treasury Bonds being THE CONTRARY OPINION MARKET goes back decades…that DECADES ago I had my first inklings that just because an entire army of sharp looking, eloquent and well credentialed analysts were unanimously certain about the market did NOT mean their predictions would prove accurate. In fact, more often than not, and I do mean this literally, the overwhelming majority of the time they were dead, dead backwards… So where are we today? With that same 99% all now crowing, “Rates gotta go higher”, is this that almost non-existent moment when they will all be proven right? If you want to bet with them, go ahead but I am aggressively going the other way…I’m Buying Treasury Bonds looking for a move well into the 140’s. I’m betting that long term rates are headed lower again…And I’m NOT just doing so because I want to be opposite all those Wall Street boobs (sorry, I know some of them are not totally clueless). I do have solid reasons why I strongly believe Treasuries are a major buy, RIGHT NOW, but if you want those reasons, they can be found outline in previous newsletters (here’s one, http://www.crokerrhyne.com/newsletters/12-21-13.htm) all of which can be read on the company website. The specific purpose of this newsletter is to show you what bull markets in Treasury Bonds have looked like for the past 30 years…and then to suggest that some version of these bullish examples is exactly what I am expecting over the next 3-6 months in today’s Treasury Bond market…So what follows here is an anthology of bull moves in Treasuries since 1982. I’ve clearly noted how big the moves have been (both in points and percent change) as well as how long each move actually took. Even if charts put you to sleep, I’d still ask that you take a little time and go through them yourself, as slowly or quickly as you prefer, and then I’ll add my own observations afterwards… Bullish Treasury Bond Moves Since 1982 Every 1 point move = $1000 per futures contract

My observations… While some of these moves can seem a bit erratic, when you just flip through them, the direction almost seems obvious…which is always easy to say in retrospect…but my impression IS: When they go, they just go. As is normal, they stop and start along the way, but when they are going up, they just keep cranking higher. Along the way up, a few 2-4 point pullbacks seem to be almost the norm. Many of the moves are 3-4 months in duration, but there can easily be month-long sideways consolidations, or corrections, as the bullish move develops. Per the averages, expecting something in the order of at least a 12-13% move seems reasonable…At today’s prices, this translates into about 15 to 17 points on the upside. This suggests that owning both at-the-money AND out-of-the-money calls makes a lot of sense…If you are expecting even just 10 points on the upside (per 32 years of history), buying calls that are 3 or 4 points out-of-the-money could lead to a big payoff (it should go without saying, if I am wrong, this could also lead to losing whatever funds you have on the table) as the potential is definitely there to have very cheap options get 3, 4 or 5 points in-the-money…wherein each point means another $1000 in intrinsic value. Just because there are 33 bull moves exhibited here does NOT mean Treasuries have to be going up right now, but if they are, I feel comfortable in saying the move probably will look very much like some of these charts…that we DO have an honest shot at seeing Bonds 15 points higher 2-3 or 5 months from now…and it is my intention to try to be there for as much of it as I can. Some trades are better than others, and some trades, as a function of what constitutes a “normal” move, do offer greater leveraged opportunities than others…I may be dead wrong but I think this is one of them. I firmly believe a powerful bull move is now fully underway. Here are a few option strategies that I like here. Here’s the basic purchase of a slightly out-of-the-money call…

Or here is an approach using Ed’s old “explosion position”. I will explain the strategy following the chart…

You are buying the June 132 call with the intent of being able to sell it profitably (as/if the market rallies) enough to recoup the entire $3969 spent on all 6 calls…Roughly estimated, I would say this would be possible somewhere around the 135 ¼ area…The potential “explosion” would then be to close your eyes (and your brain) and try to hang on to the April 134 calls (they are based on the June contract) all the way to expiration. These options have 57 days until expiration, but if they are in-the-money at expiration , you will have the choice of either selling them OR maintaining the position (all or in part) by exercising them in to futures contracts…While we will not know the outcome until several months from now, I DO believe 140 is the minimum target for June by the time it goes off the board. There are various ways to handle the position if Treasuries do move as I am anticipating but my general attitude is to TRY to trust my suppositions drawn from the 33 charts shown above…and JUST LET THE MARKET GO…TO STAY ON IT UNTIL I JUST CAN’T STAND IT ANYMORE. Obviously, I have to point out all these best laid plans are worthless if I am not right…if Bonds are going down…and if I am wrong, you stand to potentially lose every dollar you have on the table. Just as obviously, I don’t think I am going to be wrong…In fact, I don’t think I could feel any more strongly than I do about this idea… Give me a call if you want to know more…There really are many more ways to go at this…with more or less leverage, or even more or less money. For perspective, here’s the long term chart copied from my last newsletter…Every time I look at this, I think low 140’s looks like almost a given…

And also for perspective, here is the current June Treasury Bond chart (up over a point today) viewed on the same scale as all those 33 bull moves shown above…Maybe compare this one to all of them and ask yourself if a 10-15 point rally actually does look feasible from here…For my money? It absolutely DOES…and I can just as absolutely envision any of these three options being SOLIDLY in the money.

And here’s one more piece of recent news…A glimpse at which side of the fence all the “genius” advisors are on…

Thanks...Pick up the phone and call me if you have any interest at all…I honestly don’t think the risk vs reward ever gets any better than this… Bill 866-578-1001 770-425-7241 The author of this piece currently trades for his own account and has financial interest in the following derivative products mentioned within: Treasury Bonds

|

|