|

Main Page

| Philosophy

| Current

Recommendations | Newsletter Archives

Contact Us

December 20, 2025

Cotton is a roaring Buy

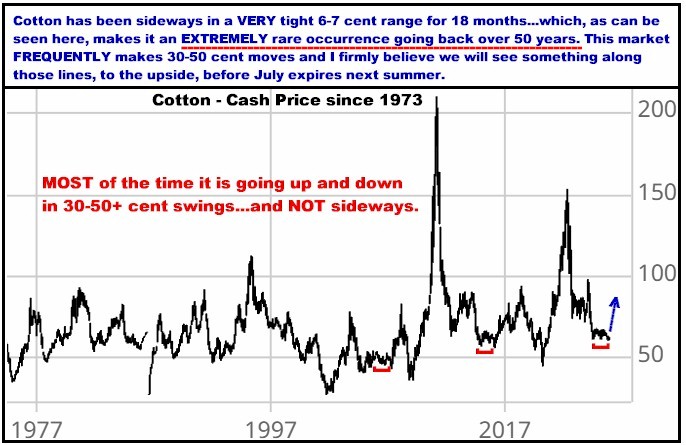

Relative to the way this market moves,

July Call Options are dirt, dirt cheap

If you told me, “You can take one position, then leave

town and not see it for the next six months,”…NO

QUESTION…this “2 &1” would be it. From a straight up 100% statistical standpoint,

going back for decades, it does not EVER get any better than this

recommendation in two critical respects. One, if I’m wrong, I should be

able to recoup 100% of what I have on the table…And two, if I am right, the

average potential gain should be of a sizeable percentage. Of

course, both of those outcomes are based on 30 years (actually 50) of data and it is obviously possible for this year to be

the first exception…thus resulting in losing up to every dollar you have

invested. BUT I WILL TAKE THESE ODDS…Irrespective of my market opinion, from an analytical

standpoint, I’ll repeat: I JUST DON’T THINK IT

GETS ANY BETTER THAN THIS.

I HAVE BEEN BULLISH COTTON DOWN HERE FOR A WHILE NOW…BUT

CONSIDERING ANY NUMBER OF STANDPOINTS…I AM NOW ROARINGLY SO…ESPECIALLY IF

YOU TAKE MY ADVICE AND POSITION OUT INTO JULY…USING “UNITS” OF 2 CALLS AND

1 PUT TO DO SO…WHY? BECAUSE THE HISTORICALLY BASED MATH SUPPORTING THE

APPROACH IS UNDENIABLE.

JULY COTTON MOVES…AND

MOVES BIG…YEAR AFTER YEAR AFTER YEAR…PRETTY MUCH FOR AS LONG AS I HAVE BEEN

IN THIS BUSINESS.

I know that charts, and tables, and historical data can

put some of you to sleep but I urge you to take the time to “get” my point

with the table that follows here…which basically documents the high

probability that this market, which has been laying here dead in the water

for 18 months, is about to do SOMETHING, and most likely it will be BIG.

TOTAL MOVEMENT, UP OR DOWN, AWAY FROM THE

MID-DECEMBER CLOSE OF JULY COTTON

BETWEEN DEC 15 AND THE CONTRACT EXPIRATION IN JULY

|

Dec 15 close

|

Percent below

Dec 15

|

Percent above Dec 15

|

Greatest per

cent change

|

|

2025

|

71.41

|

-13.1

|

+.7

|

-13.1

|

|

2024

|

81.17

|

-16.4

|

+26.4

|

+26.4

|

|

2023

|

81.25

|

-6.0

|

+10.7

|

+10.7

|

|

2022

|

102.14

|

-1.3

|

+52.7

|

+52.7

|

|

2021

|

77.00

|

-1.7

|

+25.0

|

+25.0

|

|

2020

|

68.87

|

-30.0

|

+7.4

|

-30.0

|

|

2019

|

81.34

|

-25.9

|

+.1

|

-25.9

|

|

2018

|

76.74

|

-1.29

|

+25.7

|

+25.7

|

|

2017

|

71.90

|

-2.59

|

+21.2

|

+21.2

|

|

2016

|

64.71

|

-16.0

|

+2.7

|

-16.0

|

|

2015

|

61.86

|

-4.8

|

+10.1

|

+10.1

|

|

2014

|

82.27

|

-9.4

|

+17.1

|

+17.1

|

|

2013

|

76.88

|

-1.6

|

+22.5

|

+22.5

|

|

2012

|

85.67

|

-22.8

|

+16.3

|

-22.8

|

|

2011

|

123.47

|

-.4

|

+70.0

|

+70.0

|

|

2010

|

76.19

|

-9.3

|

+14.39

|

+14.39

|

|

2009

|

45.56

|

-7.3

|

+35.3

|

+35.3

|

|

2008

|

68.90

|

-8.49

|

+37.2

|

+37.2

|

|

2007

|

56.89

|

-17.6

|

+8.19

|

-17.6

|

|

2006

|

54.70

|

-17.7

|

+8.6

|

-17.7

|

|

2005

|

43.75

|

-.1

|

+31.6

|

+31.6

|

|

2004

|

72.35

|

-35.8

|

+7.8

|

-35.8

|

|

2003

|

54.80

|

-12.1

|

+11.1

|

-12.1

|

|

2002

|

40.12

|

-18.1

|

+16.6

|

-18.1

|

|

2001

|

68.53

|

-45.3

|

+1.0

|

-45.3

|

|

2000

|

52.33

|

-4.8

|

+24.4

|

+24.4

|

|

1999

|

63.26

|

-24.5

|

+1.79

|

-24.5

|

|

1998

|

69.16

|

-9.9

|

+20.4

|

+20.4

|

|

1997

|

77.87

|

-9.6

|

+1.4

|

-9.6

|

|

1996

|

83.59

|

-17.4

|

+7.8

|

-17.4

|

|

1995

|

84.45

|

-2.1

|

+36.4

|

+36.4

|

Quite obviously, the big point here is what you see in

the highlighted column…that going back to 1995, between now and expiration

of the July contract, Cotton has averaged a 25%

move, either up or down, away from its Dec 15th close. During 17

of those years, the average move up was 28 cents…and in 14 of those years,

the average move was down 22%...and only ONE year, of -9.6%, which was not

in double digit percentages.

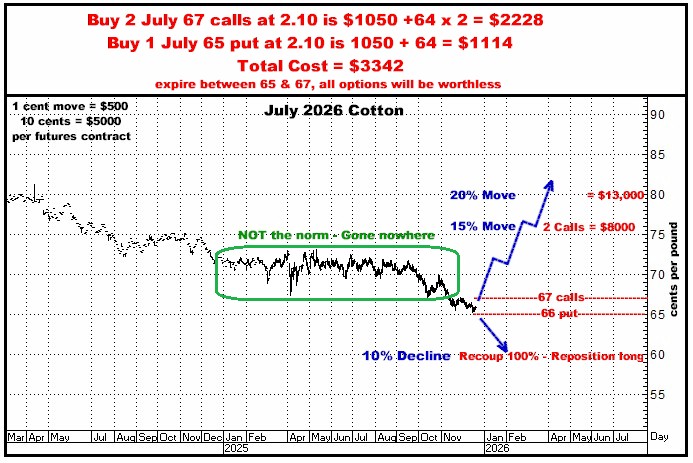

WITH JULY AT 66 CENTS ON

DECEMBER 15TH, A 25% MOVE WOULD BE ABOUT 16.5 CENTS…ONE WAY OR

THE OTHER…WHICH WOULD BE FAR MORE THAN ENOUGH TO HAVE THIS RECOMMENDATION

RECOUP THE ORIGINAL INVESTMENT…OR REALISTICALLY BE ABLE TO SCORE SOMETHING

LIKE A 400% GAIN.

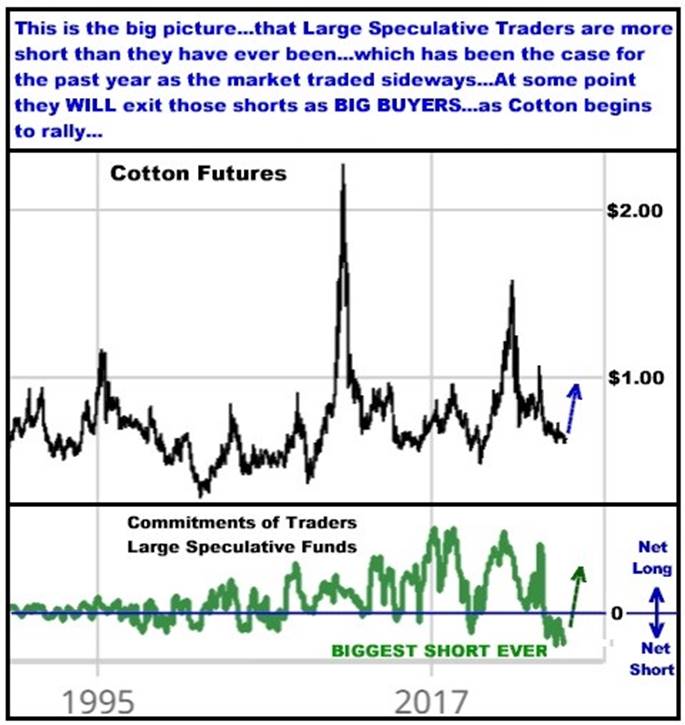

And the MASSIVE spec short in Cotton still keeps this

market, in my old hack opinion, totally, totally primed for an upside

explosion…

HOW TO BUY IT…

Quite honestly, during the past year, I got away from

using the Both Sides Strategy, which I have forever believed/KNOWN is the

best way to position in the futures markets. In fact, two of my personal

wall reminders regarding trading (of 8 total) are:

IF YOU ARE NOT WILLING TO BUY BOTH SIDES, DO NOT DO THE

TRADE.

LOOK FOR RANGE TRADE 2&1 SETUPS THAT PUT YOU IN A

POSITION TO WIN BIG. THERE IS NO BETTER TRADE.

And that is what I have here in Cotton…and if you can

see what I trying to show you as to why I am making this recommendation…I

absolutely see the “2&1” as the way to do this, as, if Cotton does go

lower, you can recoup 100% of the funds invested, and then

you can reposition at even lower prices…And on the flip side,

the potential dollar gains shown below are very real when

Cotton does go up, which it WILL. But you do

have to be there when it does…

You have no idea how bearish the industry wide sentiment

is…which IS what you basically have had at every commodity market bottom in

history…where low prices, and laying there forever

just convinces the whole trading world that “there’s no way it’s going up

from here.”

My view is that very strong hands have been quietly

accumulating Cotton for the past year…And with this market having a 50 year history of almost routinely going from being “on

its ass” to leaping 30-50 cents higher, I THINK THAT IS WHAT WE ARE GOING

TO SEE IN 2026…quite possibly beginning right out of the gate. In

other words, 2025 was “nowhere,” and 2026 will be exactly the opposite.

Another rule…Be enthusiastic when no one else is.

Contact me if you want to know more…

Thanks. Enjoy you holidays.

Bill

770-425-7241

866-578-1001

All

option prices in this newsletter include all fees and commissions. All

charts, unless otherwise noted, are by Aspen Graphics and CRB.

FUTURES

TRADING IS NOT FOR EVERYONE. THE RISK OF LOSS IN TRADING CAN BE

SUBSTANTIAL. THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE

FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PAST PERFORMANCE IS NOT

INDICATIVE OF FUTURE RESULTS. THERE IS NO GUARANTEE YOUR TRADING EXPERIENCE

WILL BE SIMILAR TO PAST PERFORMANCE.

The author of this piece currently trades for his own

account and has a financial interest in the following derivative products

mentioned within: Cotton

|