|

Main Page

| Philosophy

| Current

Recommendations | Newsletter Archives

Contact Us

Landline 770-425-7241

Cell 770-366-3070

November 5, 2025

Both Cattle Contracts Limit Down Again

Feeders down 9.25 cents $(4625 per futures)

Live Cattle down 7.25 cents ($2900 per futures)

The Cattle Complex has been devastated during the past

few weeks, and while I personally remain short, and do think this collapse

has a LONG way to go, I cannot recommend entering new positions at current

levels. For one thing, with the limit down closes today, and pools of

contracts of traders attempting to sell, but could not, there is no telling

what tomorrow’s opening and ensuing trade will be…especially considering

that the daily limit will be expanded to 13.75 cents in Feeders and 10.25

in Live Cattle…Volatility is through the roof, making options prohibitively

expensive, and regarding new positions, I think it best to wait for some

sort of consolidation and/or upside retracement to either short futures or

buy puts…But make no mistake…I REMAIN SHORT and REMAIN BEARISH and FULLY

EXPECT TO SEE BOTH CONTRACTS GO DISATROUSLY LOWER OUT INTO EARLY NEXT

SPRING.

But I AM NOW

ABSOLUTELY BULLISH CORN, COTTON, WHEAT AND SOYBEANS…

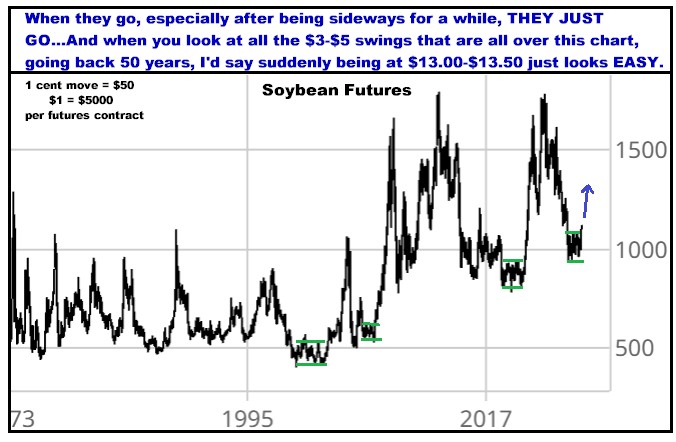

Just for brevity, here’s the Soybean contract which

closed into new 1 year highs again today…and quite honestly, with this

background of a China deal having been made…AND the fact that the Supreme

Court may be cancelling this whole tariff thing, MY SENSE IS THAT SOYBEANS

COULD BE IN A TOTAL LIFT OFF MODE…And whether you use the 2&1 (which is

smart) or just buy them outright, I THINK THIS IS A GREAT, GREAT BET…AND

IMMEDIATELY SO.

The Big Picture…

Get in touch if you want to know more…

Thanks,

Bill

770-425-7241

866-578-1001

All

option prices in this newsletter include all fees and commissions. All

charts, unless otherwise noted, are by Aspen Graphics and CRB.

FUTURES

TRADING IS NOT FOR EVERYONE. THE RISK OF LOSS IN TRADING CAN BE

SUBSTANTIAL. THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE

FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PAST PERFORMANCE IS NOT

INDICATIVE OF FUTURE RESULTS. THERE IS NO GUARANTEE YOUR TRADING EXPERIENCE

WILL BE SIMILAR TO PAST PERFORMANCE.

The author of this piece currently trades for his own

account and has a financial interest in the following derivative products

mentioned within: All of them

|