|

Main Page

| Philosophy

| Current

Recommendations | Newsletter Archives

Contact Us

November 2, 2025

Special report on Cotton---

and

ALL four row crops

Looking Very Bullish

As I wrote two weeks ago, I am now long Corn, Cotton,

Soybeans and Wheat…that the past year’s sideways action, combined with what

seems to be just an overwhelming mountain of negative opinion, has led me

to conclude that all of these markets have bottomed…And that furthermore, I

could envision ANY good news absolutely lighting a fire underneath them…And

vis-à-vis this weekend’s news regarding China, I THINK THAT LAST WEEK AN

ACROSS-THE-BOARD BULL MARKET GOT STARTED IN ALL FOUR OF THESE ROW CROPS.

MY RECOMMENDATION

IS TO OWN ONE CALL IN ALL OF THEM AS ONE “UNIT,” TO BUY THEM HERE…AND

FORGET THEM FOR THE NEXT 2-3 MONTHS.

With closes on their weekly highs in all of them Friday,

combined with China’s announcement yesterday to suspend “all regulatory

tariffs that it has announced since March 4, 2025,” I have no idea what

sort of openings we will get in these markets tonight and tomorrow

morning…Nevertheless, further below I will include option recommendations

in each market…

But first…some

specifics on the COTTON MARKET…which I truly regard as being potentially

explosive.

I have been pointing out that Cotton routinely seems to

make 30-50 cent swings every few years, and that, after being dead sideways

in a 6-7 cent range for the past year, and with Speculative Funds having a

massive short position, I THINK COTTON IS FLATASS READY TO GO ON THE

UPSIDE…And what follows may seem like

gobbledygook but if you wade through each step below I think you will be

able to understand why I am so IMMEDIATELY BULLISH…

Start with this…

Now looking back at the

past year…and more specifically, what has been happening since July 1st…

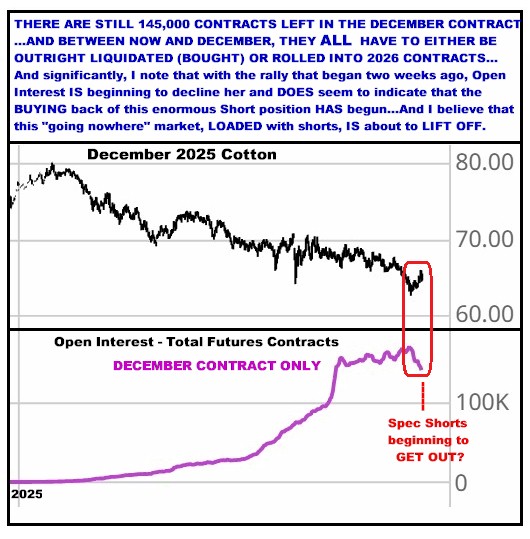

Aside from the fact that Funds are RECORD SHORT, while

Commercial Traders are RECORD LONG (not shown here), what really

interests me is the 100,000 contract increase in

Fund shorts that has occurred since July 1st. During these last 4

months Cotton has traded between 68 & 64 cents, which would mean that

their average entry price is probably somewhere close to 66 cents...not to

mention that this is basically the same level at which they have entered

this massive Short Position during the past year...meaning that ANY further upside move from here

could/should see them being "forced" into buying...and per the

numbers, doing so in a BIG WAY.

And here is the near

term…And which is the point of all this...

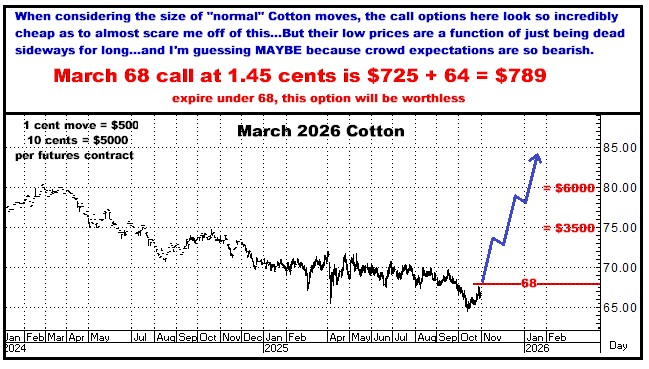

Even though the explosion

I am anticipating will be led by the December, ALL of the Cotton contracts

will be rallying as well, and I therefore think you can position in any of

them all the way out to the July contract. At this moment, however, as

outlined in my last newsletter, I am sticking with the March.

SOYBEANS

WHEAT

CORN

Take you

pick. I think they are ALL going on the upside. Buy one, or two or all of

them…for about $4200. As I’ve said before, if I am dead wrong on all of

them, you lose the $4200…But having just one of them work probably makes

the whole thing a bit profitable…and getting 2, 3 or 4 right

would add up to substantial gains.

Call if you want to know

more,

Thanks,

Bill

770-425-7241

866-578-1001

All

option prices in this newsletter include all fees and commissions. All

charts, unless otherwise noted, are by Aspen Graphics and CRB.

FUTURES

TRADING IS NOT FOR EVERYONE. THE RISK OF LOSS IN TRADING CAN BE

SUBSTANTIAL. THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE

FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PAST PERFORMANCE IS NOT

INDICATIVE OF FUTURE RESULTS. THERE IS NO GUARANTEE YOUR TRADING EXPERIENCE

WILL BE SIMILAR TO PAST PERFORMANCE.

The author of this piece currently trades for his own

account and has a financial interest in the following derivative products

mentioned within: All of them

|