|

Main Page

| Philosophy

| Current

Recommendations | Newsletter Archives

Contact Us

Research and recommendations by Bill Rhyne

For more info or consultation…

Landline 770-425-7241

Cell 770-366-3070

October 29, 2025

Fantastic Math

BUY COTTON NOW

Cotton can be stored for

years without any degradation in quality.

And when you combine that with the fact that Cotton

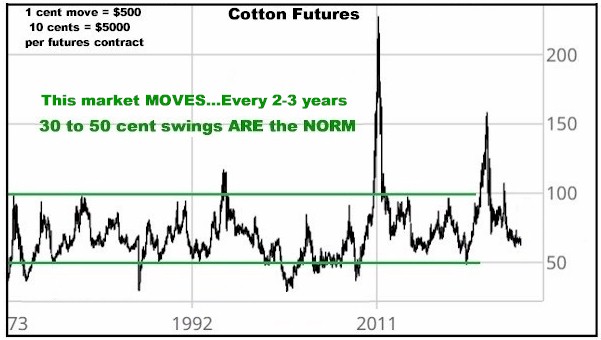

almost ROUTINELY trades up at least 30-40 cents every 2-3 years, it makes

sense for large trading houses to accumulate it when prices are low and

hold it until prices rise again. In other words, using a simple

calculation, if you

can buy it at 70 cents and “know” it can be sold for $1.00 within the next

few years, you are talking about a 40+% return on your investment

in a commodity that you know WILL be consumed at some point in the future.

According to my digging around with ChatGPT, about 7

million bales of last year’s 14 million bale USA crop can be estimated to

still be in storage, with the farmers who grew it MAYBE still controlling a

mere 1-3% of that Cotton…Which, plain and simple, suggests to me that the remaining

97-99% (all of it in other words) of that Cotton is potentially now sitting

in very “strong hands” that have ZERO desire to sell until prices reach

substantially higher (normal) levels. Obviously

this is an opinion on my part…I certainly do not know what those owners

might be thinking, but I seriously doubt that they have been accumulating

the crop for the past year with the intention of selling it for a few extra

cents on the dollar.

Here is what I mean…

Makes sense to me…

Especially when you take the past 40 years of statistics

shown below into consideration…with the

bottom line being that between now and the March contract expiration,

COTTON MOVES…AND IT MOVES A LOT…YEAR AFTER YEAR AFTER YEAR…

What

follows is a history of how much the March Cotton contract moves

between August 31st and its expiration 7 months later…The

data starts with the August 31 close and then notes the biggest move away

from that close…in whichever direction that move might be before the

contract goes off the board.

The

point made here is that Cotton DOES move significantly during those 7

months…AVERAGING a 24% change in price in one direction or the other…which

lends itself to some VERY interesting option possibilities.

First

up…the stats going back 40 YEARS…with the 4th column being of

the greatest importance…

|

|

Aug 31

Close

|

Greatest

Change

In cents

|

Greatest

Change

In %

|

|

2025

|

71.65

|

- 10.03

|

- 13.9%

|

|

2024

|

87.77

|

+ 19.48

|

+ 22%

|

|

2023

|

110.14

|

- 40.04

|

- 36%

|

|

2022

|

91.77

|

+ 37.60

|

+ 40%

|

|

2021

|

66.05

|

+ 26.90

|

+ 40%

|

|

2020

|

59.49

|

+ 12.52

|

+ 21.1%

|

|

2019

|

59.50

|

- 19.97

|

- 33.5%

|

|

2018

|

70.11

|

+ 17.64

|

+ 25.1%

|

|

2017

|

66.01

|

+ 12.49

|

+ 18.9%

|

|

2016

|

62.58

|

- 5.61

|

- 9.6%

|

|

2015

|

67.01

|

- 9.96

|

- 14.8%

|

|

2014

|

82.74

|

+ 8.28

|

+ 10%

|

|

2013

|

77.98

|

- 8.69

|

- 11.1%

|

|

2012

|

103.26

|

- 18.91

|

- 18.3%

|

|

2011

|

84.74

|

+ 142.26

|

+ 168%

|

|

2010

|

62.05

|

+ 22.27

|

+ 35.8%

|

|

2009

|

74.38

|

- 35.15

|

- 47.2%

|

|

2008

|

64.31

|

+ 22.07

|

+ 42%

|

|

2007

|

58.73

|

- 7.92

|

- 13.4%

|

|

2006

|

51.57

|

+ 7.68

|

+ 14.9%

|

|

2005

|

55.50

|

- 13.78

|

- 24.8%

|

|

2004

|

61.36

|

+ 24.64

|

+ 40%

|

|

2003

|

48.49

|

+ 5.09

|

+ 10.5%

|

|

2002

|

40.88

|

- 11.02

|

- 27%

|

|

2001

|

66.73

|

- 15.23

|

- 22.8%

|

|

2000

|

51.92

|

+ 9.78

|

+ 18.8%

|

|

1999

|

71.72

|

- 15.72

|

- 21.9%

|

|

1998

|

74.27

|

- 11.22

|

- 15.1%

|

|

1997

|

77.55

|

- 6.70

|

- 8.6%

|

|

1996

|

84.52

|

+ 10.68

|

+ 12.6%

|

|

1995

|

69.090

|

+ 44.77

|

+ 64%

|

|

1994

|

58.08

|

+ 21.57

|

+ 37.1%

|

|

1993

|

55.56

|

+ 8.84

|

+ 15.9%

|

|

1992

|

67.15

|

- 15.55

|

- 23.1%

|

|

1991

|

73.30

|

+ 15.1

|

+ 20.6%

|

|

1990

|

75.52

|

- 11.37

|

- 15%

|

|

1989

|

57.60

|

+ 8.95

|

+ 17.3%

|

|

1988

|

77.88

|

- 19.38

|

- 24.8%

|

|

1987

|

37.52

|

+ 24.21

|

+ 64.5%

|

|

1986

|

59.71

|

- 5.34

|

- 7.8%

|

|

|

Avg Change

|

+/- 16.4

CENTS

|

+/- 24%

|

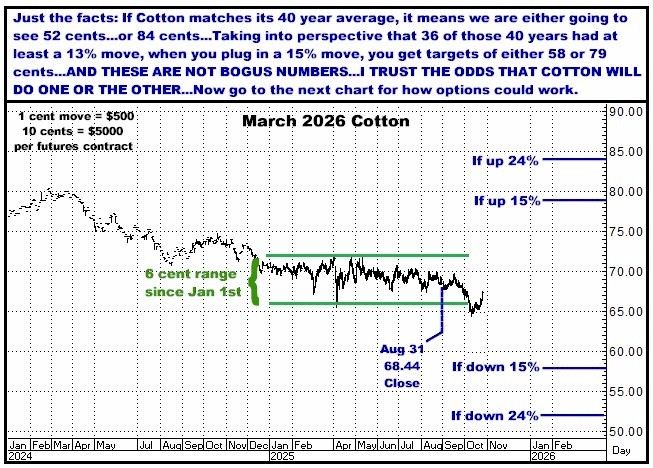

So it DOES move…? And in fact, using the August 31st close of

approximately 69 cents a pound, if Cotton were to match the 24% average, it

would mean about a 16 cent move…either up or down…before we get to March 31st…And

with two months having passed since August…with still having had very

little movement…I’d say the odds of something big beginning…NOW…have

certainly increased. When you then throw in that this contract has

basically been trading dead, dead, dead sideways for the entirety of 2025

and I think the case for a big move just

goes through the roof…And per this next chart, I WANT TO BE LONG…RIGHT

HERE…RIGHT NOW.

Commitments of Traders

And here’s what the lay

out is if it does match its average…or as noted, just moves 15% in either

direction.

I MIGHT BE DEAD WRONG BUT

I THINK COTTON IS POISED TO ERUPT ON THE UPSIDE AND REGARD IT AS A

SCREAMING BUY.

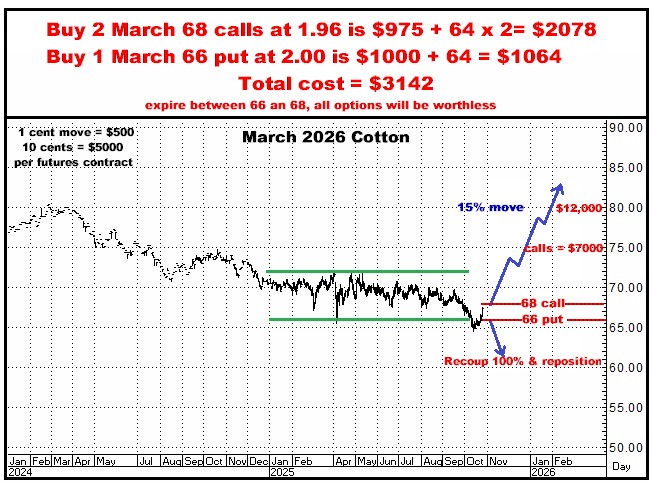

And here is where options come in and my reason for

referencing FANTASTIC MATH…

First up…For what Cotton could/should do between now and

March, I view both call and put options as being dirt, dirt

cheap…which, for my money, presents two possible approaches:

One would be, that with the knowledge it could

still go down, using the 2 & 1 approach here is NOT

expensive and does make sense as it does mean that breaking even lower does

offer the possibility of getting your money back…and then re-positioning at

even better prices.

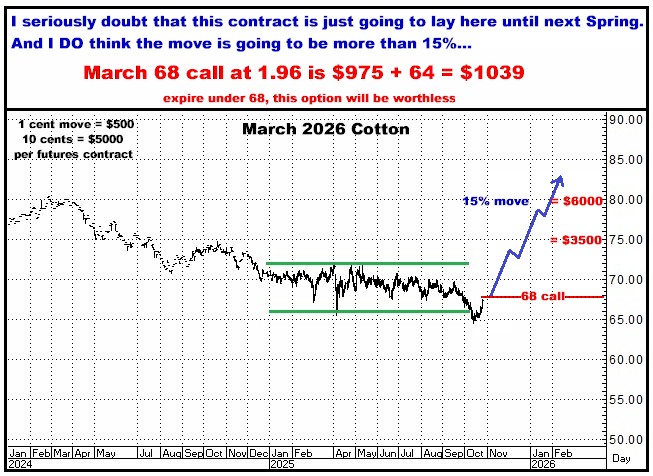

And two, if want to make the

assumption that it MUST be a buy here…or that there is very little

downside potential…you can just buy the calls, which have a

ton of leverage…and be ready to maybe do more if Cotton does drop any

lower.

Truth is, either approach is viable…but I am personally

using both of them…that is, some 2&1’s and some naked calls.

Here are recommendations for both…

Units of 2 Calls and 1

Put

Just buying Calls

Call if you want to know more…

Thanks,

Bill

770-425-7241

866-578-1001

All

option prices in this newsletter include all fees and commissions. All

charts, unless otherwise noted, are by Aspen Graphics and CRB.

FUTURES

TRADING IS NOT FOR EVERYONE. THE RISK OF LOSS IN TRADING CAN BE

SUBSTANTIAL. THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE

FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PAST PERFORMANCE IS NOT

INDICATIVE OF FUTURE RESULTS. THERE IS NO GUARANTEE YOUR TRADING EXPERIENCE

WILL BE SIMILAR TO PAST PERFORMANCE.

The author of this piece currently trades for his own account

and has a financial interest in the following derivative products mentioned

within: Cotton

|