|

Main Page

| Philosophy

| Current

Recommendations | Newsletter Archives

Contact Us

October 27, 2025

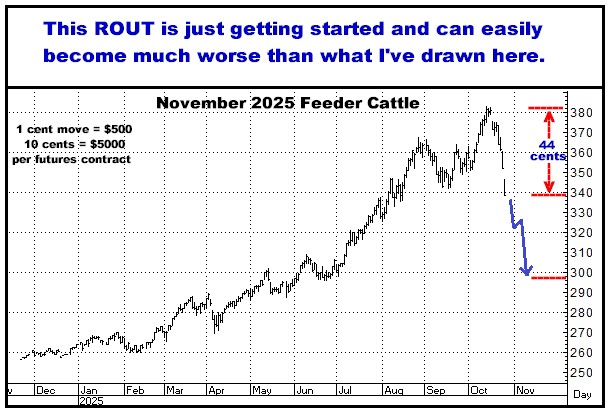

CATTLE MARKET TRULY BEGINNING TO CRASH

And ROW CROPS STARTING TO LIFT OFF

What to say? Locked limit

down in Feeders for the 2nd day in a row, with today’s expanded

limit to 13.75 cents meaning they have now dropped 44 cents, or $22,000 per

futures contract, during the 7 trading days…with Live Cattle having been

hit for 27 cents, or $10,800 per contract at the same time. AND I FIRMLY

BELIEVE THEY ARE JUST GETTING STARTED…

With action like you can see on the chart below, I have

zero doubt that the MASSIVE Long Position held by Speculative Funds is now

beginning a forced liquidation (SELLING). Next, put that together with the

fact that the equally massive positions held by actual Feeder Cattle buyers

are now also LOSING big bucks (and I assure you, are NOT even thinking of

stepping up to buy again)…and then what you DO have is the scenario I've been describing

as, AN AVALANCHE OF SELLING AND A VACUUM OF BUYING, which does typically

result in a GIGANTIC STRAIGHT DOWN TRADE...And I firmly believe that is

exactly what we are starting to see now.

There’s no point here in

showing you option prices t as tomorrow’s opening trade will probably not

be anything close to where prices finished today.

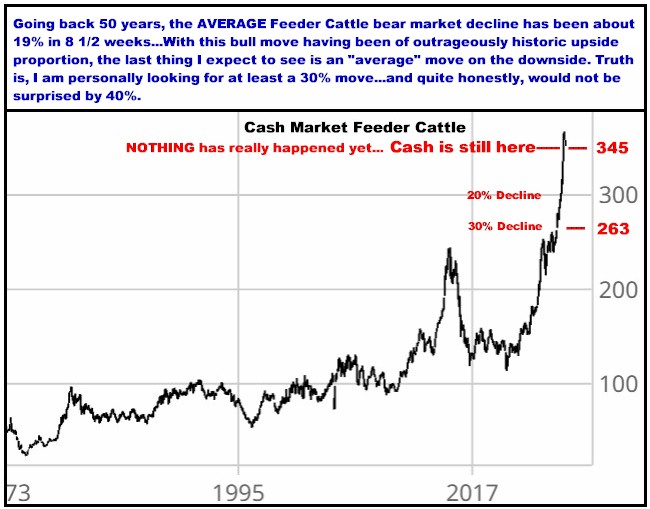

I will say this however: Do

NOT be thinking, “Oh. I missed it.” Take a look at this next chart and do

understand that NOTHING HAS REALLY HAPPENED YET…that all we really

have is what I’d call a high probability confirmation that the top is

in…And that there is still a LONG, LONG WAY TO GO ON THE DOWNSIDE. It is

not even close to be too late to get on this…

No idea what tomorrow’s open

will be…or what option prices will make sense…Give me a call if you want

ideas as to how to go about getting on…

Buy the USA Row Crops

As noted last week, after

3 ½ years of being bearish Corn, Wheat and Soybeans, I have reversed my

opinion and now see the past year’s action as having formed a major bottom

in all three…and also including Cotton…and that it is now time to BUY ALL

FOUR OF THEM. My basic premise, aside from the fact that they have

had ample time and opportunity to break down lower during the past 5-6

months…and they did NOT…my perception has become that the current mob

psychology attitude towards all of these crops had finally become

overwhelmingly negative, with any number of analysts who for 3 bearish

years have been unendingly bullish, NOW talking in terms of “no where to go but down from here,” citing the trade

war, record crops, and “no place to store it all,” with all of these

“reasons” being exactly the kind of talk you DO get grain market bottoms.

I summed it up with: Virtually

all of the news currently out there is horribly negative and the fact that

it has NOT broken the markets is quite possibly a sign that we have bottomed and that ANY good news will produce a significant rally.

And that IS what I think we

started to see today…LED BY SOYBEANS, UP 25

CENTS & MAKING NEW ONE YEAR HIGHS…

WHAT

TO DO HERE…NOW

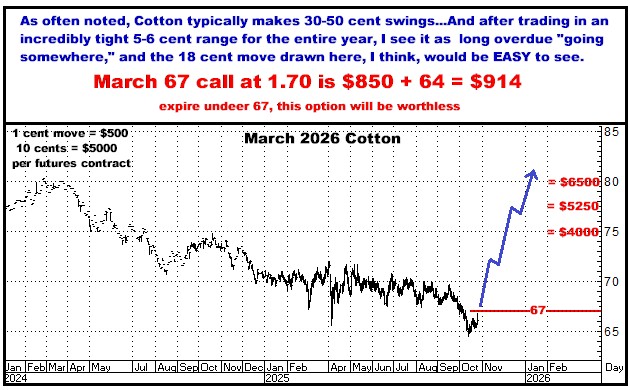

I’m keeping this short. My

recommendation is to buy “units” of 1 call each in Corn, Cotton, Soybeans

and Wheat…and forget you own them for the next 3-4 months. If I am

wrong about all of them, you could lose every dollar you invest. If I get

just one right, and the rest dead wrong, I still think you will probably

come out a little bit ahead…And beyond that, you can do the math as to

where you will be if I get 2,3 or all 4 right.

HERE ARE THE OPTIONS I LIKE

HERE…RIGHT HERE…RIGHT NOW AS THEY DO LOOK LIKE THEY ARE ON

THE MOVE…

I say BUY THEM All…or just buy

some of them…but definitely do SOMETHING while they are here…and appearing

to be beginning potentially big moves higher. Buying All Four will cost about $4331…So just do the

math yourself as to what could happen here…And it may be a dumb statement

to make, but for my money, I think it is close to impossible that none of

them will have made some sort of significant move on the upside between now and March.

Call me if you want to know

more…

Thanks,

Bill

770-425-7241

866-578-1001

All

option prices in this newsletter include all fees and commissions. All

charts, unless otherwise noted, are by Aspen Graphics and CRB.

FUTURES

TRADING IS NOT FOR EVERYONE. THE RISK OF LOSS IN TRADING CAN BE

SUBSTANTIAL. THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE

FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PAST PERFORMANCE IS NOT

INDICATIVE OF FUTURE RESULTS. THERE IS NO GUARANTEE YOUR TRADING EXPERIENCE

WILL BE SIMILAR TO PAST PERFORMANCE.

The author of this piece currently trades for his own

account and has a financial interest in the following derivative products

mentioned within: All of them

|