|

Main Page

| Philosophy

| Current

Recommendations | Newsletter Archives

Contact Us

October 19, 2025

IT’S FINALLY TIME TO GET LONG…

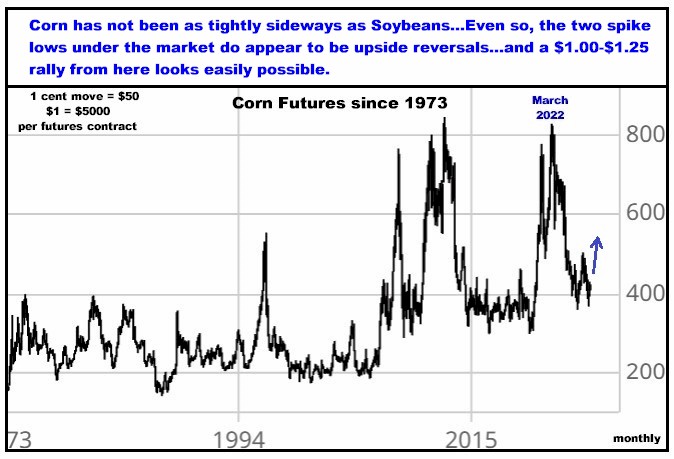

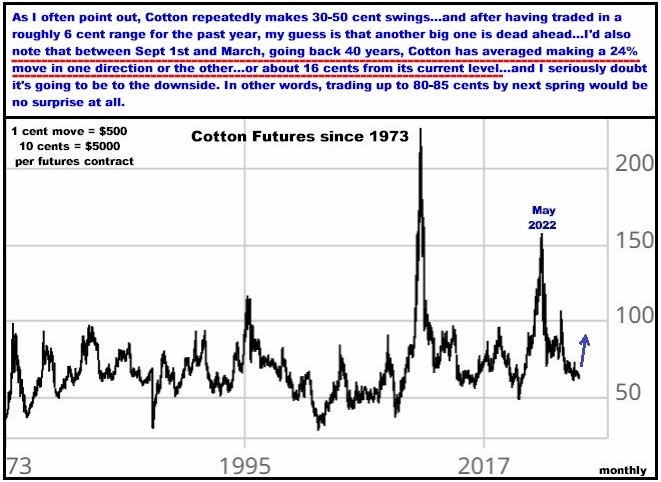

About 3 ½ years ago, when Russia had begun their

invasion of Ukraine, with Soybeans at $16, Wheat at $11, Corn at

$8.00, and Cotton at $1.25, I wrote the following:

MAY 7, 2022

It may be a stupid

statement to make, but my opinion is that is just about impossible for

these markets (Corn, Cotton, Soybeans, Wheat) to remain at their current

levels…and that all of them WILL get clocked for a minimum of

30% of their top tick values…and that the odds are now EXTREMELY high that

ALL FOUR OF THESE MARKETS HAVE RECENTLY MADE THEIR HIGHS…for YEARS to come.

And while I have been on both the short and long side of

Cotton during the past few years, I have been resolutely bearish

Corn, Wheat and Soybeans ever since that major 2022 high…but am now

reversing that opinion. I THINK IT IS TIME TO BUY ALL FOUR MARKETS,

which, when you get down to it, have basically been the DOGS of the

investment world for pretty much the entire last year.

Without getting into the details of supply and demand,

I’ll simply say that I don’t think the environment surrounding these crops

can get any worse than is now the case…Between Trump’s globally

antagonistic rhetoric and tariffs…and China’s total void of buying…and the

whole world knowing that there are big, big crops now heading towards

harvest, with stories beginning to crank up about, “nowhere to store it

all,”…and lastly the fact that whole herds of agricultural analysts, having

been wrongly “forever bullish” for the past 3 years, are NOW talking in

terms of the “inevitability of lower prices ahead,” MY OPINION

IS THAT A ROUGHLY YEAR LONG BOTTOM HAS BEEN FORMED AND IT IS TIME TO BUY

CORN, COTTON, SOYBEANS AND WHEAT…ALL OF THEM…AS ONE “UNIT.”

For quite some time I have been looking for one last

downside collapse in Corn and Soybeans, with my expectation being that the

final stage of these bear markets would see farmers, still holding massive

stocks from last year’s harvests, capitulating in a “just sell it” straight

down move sharply below the roughly year long

sideways ranges we’ve seen in both markets…But that has not happened , the

result being that I have come to view this firmness as a floor/bottom for

prices, meaning that the next likely move will be to the upside. As noted

above, virtually all of the news out there is horribly negative and the

fact that it has NOT broken the markets is quite possibly a sign that ANY

good news will produce a significant rally.

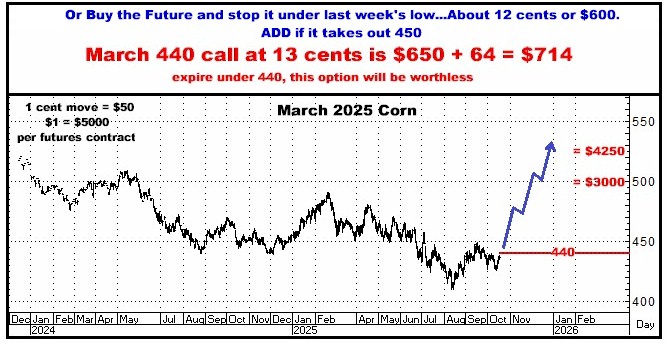

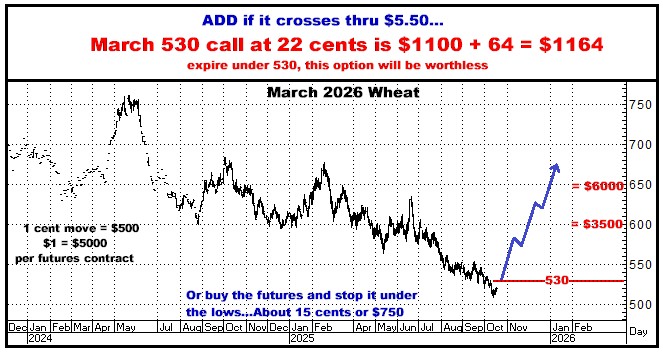

I LOVE THE MATH HERE…Of

buying calls in all four markets and how the dollars work if just ONE of

them rallies from here…not to mention what happens if two, or three or all

of them get going on the upside.

Regarding SOYBEANS – Do

read this paragraph…

During the 2024-25

season, China's Soybean purchases here were down 75% compared to the

previous crop year. And so far this

fall, they have made ZERO purchases of new crop Soybeans, compared to

having bought about 12.5 million metric tons by this time in 2024...With

China being the world's largest Soybean importer, these are stunning

numbers, but EVEN MORE STUNNING IS THE FACT THAT THIS TOTAL LACK OF BUYING

DID NOT SEND PRICES LOWER DURING 2025...WHICH I CAN NOW ONLY PERCEIVE AS

REFLECTING AN UNDERLYING BULLISHNESS TO THIS MARKET. I mean, really, if all

the shitty, shitty news didn't send prices lower, what will? Soybeans tend

to be quite volatile, and $3-$5 moves have become the norm…My feeling

is that ANY remotely positive news right now could light a bullish fire

under Soybeans, and really, all four of these USA ROW CROPS…

Buying all four of these markets as one unit would

cost about $4400. None of the

potential moves I have drawn here are anything close to being big…simply

the beginnings of bull markets that I think will be taking place for the

next few years. If I am wrong here, and all of them go in the tank, or do

nothing, you can lose everything you put on the table. Do the math yourself

if I am only half way right…or completely so.

SOYBEANS

CORN

WHEAT

COTTON

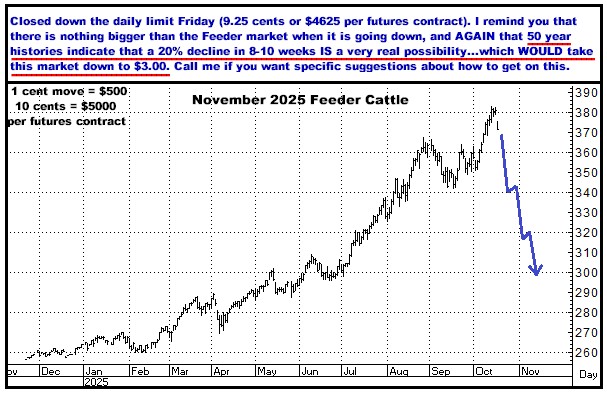

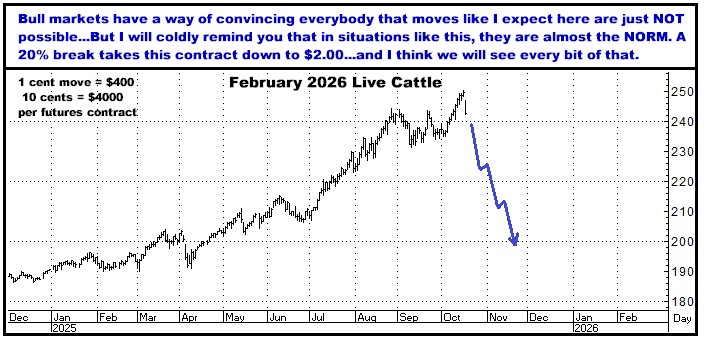

And a quick note on Cattle, which gapped sharply lower

on Friday…and closed limit down in the Feeders and dead hard on their lows

in Live Cattle. Everything I have written for the past year still

stands…There will come a point when the Cattle complex cracks wide open and

“the bottom falls out” will be a monster understatement…Where they

start dropping, and DON’T bounce back and DO drop 20-25% in within a month

or two…and then go on from there to destroy a whole herd of cattle

investors over the next 18-24 months…At any rate, it will be interesting to

see where this market does in the week ahead…

I CONTINUE TO RECOMMEND BUYING PUTS IN BOTH FEEDER

CATTLE AND LIVE CATTLE.

And I’ll say it

one more time…The fact that I HAVE been wrong has nothing to do with what

happens next with my recommendations.

Contact me if you want to know more…There are lots of

way to go about participating in any of these ideas.

Thanks,

Bill

770-425-7241

866-578-1001

All

option prices in this newsletter include all fees and commissions. All

charts, unless otherwise noted, are by Aspen Graphics and CRB.

FUTURES

TRADING IS NOT FOR EVERYONE. THE RISK OF LOSS IN TRADING CAN BE

SUBSTANTIAL. THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE

FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PAST PERFORMANCE IS NOT

INDICATIVE OF FUTURE RESULTS. THERE IS NO GUARANTEE YOUR TRADING EXPERIENCE

WILL BE SIMILAR TO PAST PERFORMANCE.

The author of this piece currently trades for his own

account and has a financial interest in the following derivative products

mentioned within: Corn, Cotton, Soybeans, Wheat, Feeder Cattle, Live Cattle

|