|

Main Page

| Philosophy

| Current

Recommendations | Newsletter Archives

Contact Us

September

9, 2025

This

newsletter addresses Interest Rates and the Stock Market, but before diving

into what I think is EXTREMELY pertinent research, here’s a quick update on

today’s Limit Down Close in Cattle.

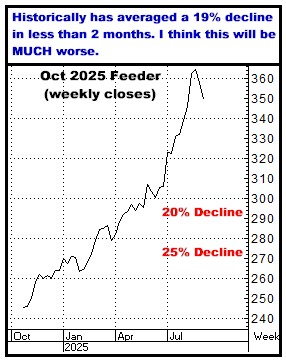

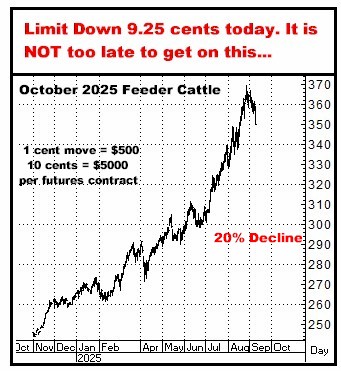

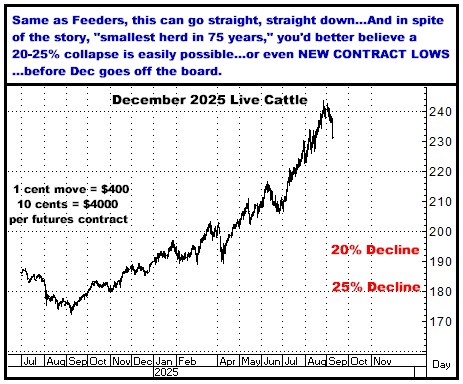

Last week, both Feeder

Cattle and Live Cattle had their first weekly reversals lower in six weeks.

Is this it? On no news, they were sliding lower every day from Monday thru

Friday last week…And then started this week, again on NO NEW, with both

contracts in the tank, INCLUDING 9.25 CENT ($4625 PER FUTURES CONTRACT

LIMIT DOWN IN FEEDERS.

As I have

repeatedly pointed out, the Cattle market is more LOADED with Spec Longs

than at any time in history (by miles)…and that when the break comes, there will be no

attributable news to “justify” it as, per 50 years of history, they pretty

much just go straight, straight down…And oh, yeah, I KNOW there are a TON

of people out there thinking, “They’ve done this before. They’ll go right

back up,” or, “This is just a correction. The cattle just ain’t out there.”

And this is, as it is at EVERY top, is going surprise the you-know-what out

of all of them.

JUST AN AVALANCHE OF

LIQUIDATION IS COMING…and I’m sorry, but a whole country full of cattlemen

who have blindly bought calves and steers up here at the most insane prices

EVER are about to get blasted.

No telling what today’s

limit down close will bring tomorrow…so it’s useless to post any option

quotes today. DO know this, I believe, is just the 2nd week of a

6 month move…so no…you haven’t “missed it.” But if you have thought about

getting on, I’d say go ahead and call me and GET IT DONE…

BUY

THE 10 YEAR NOTES

BUY TREASURY BONDS

I am both right and wrong about the

markets…But one thing I “know” is that: WHEN YOU KNOW THE WHOLE

SPECULATIVE WORLD IS ON ONE SIDE OF THE FENCE, AND I DON’T CARE HOW STRONG

THEIR “LOGIC” APPEARS TO BE…YOU BET IN THE OPPOSITE DIRECTION.

Or to quote one of the greatest traders

ever, “Start by assuming the market is always wrong, so if you copy everybody

else on Wall Street, you're doomed to do poorly.”

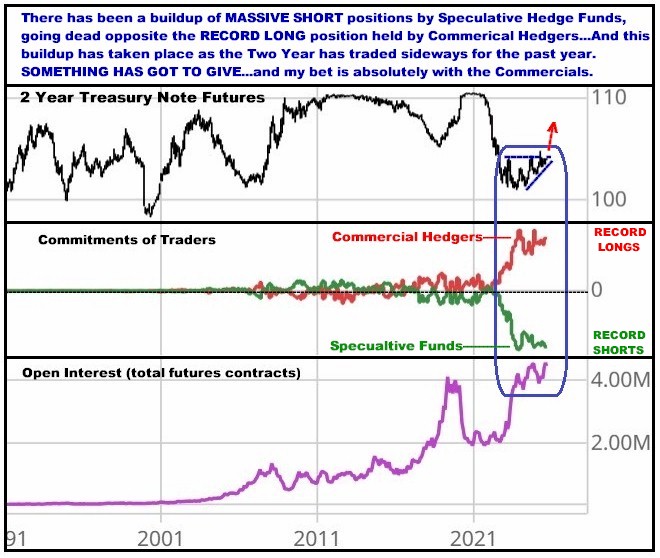

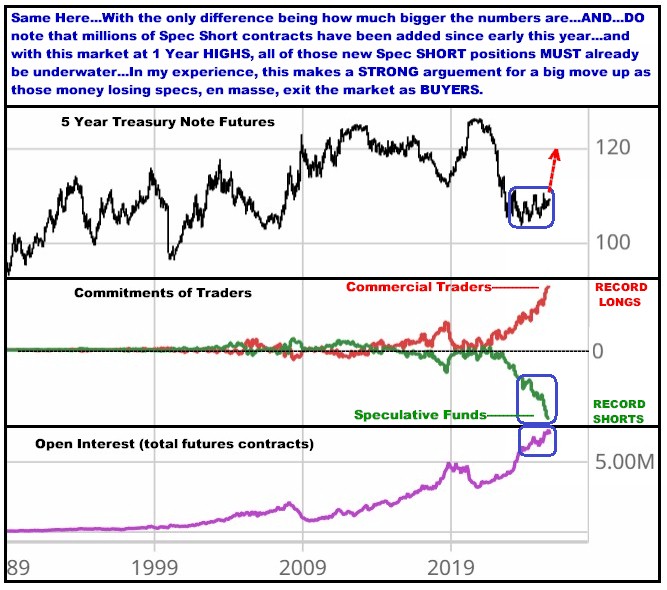

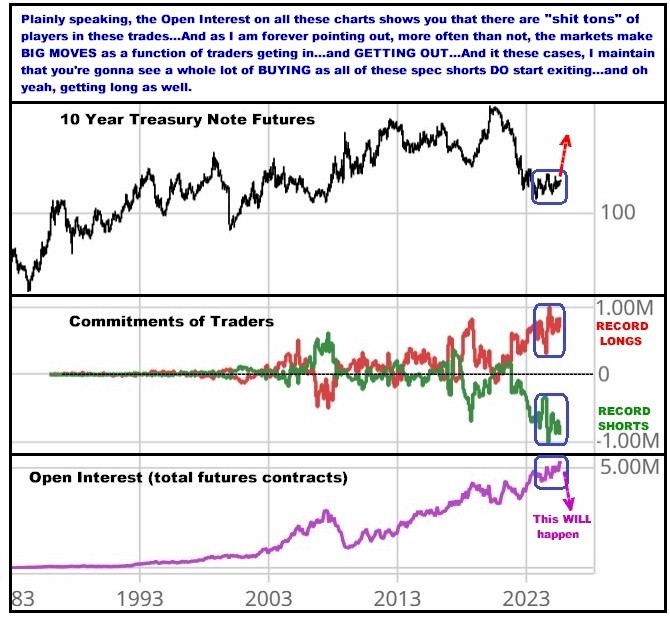

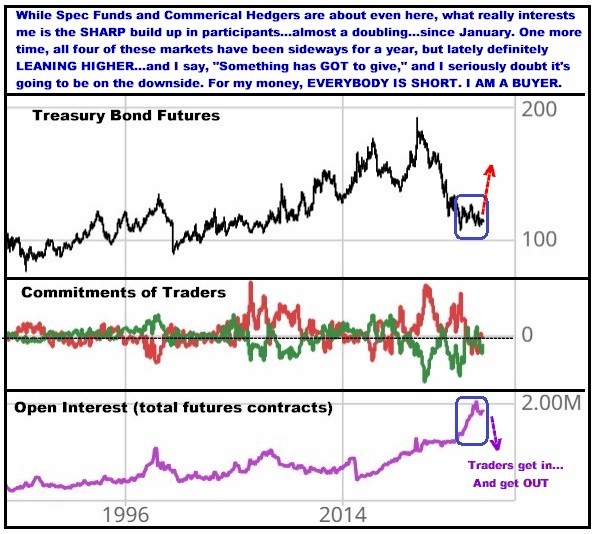

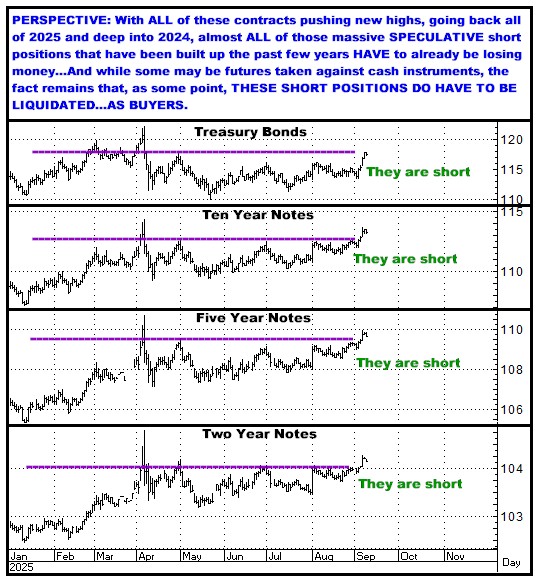

I HAVE NEVER EVER SEEN WALL STREET SPECULATORS AS ONE

SIDED IN THE MARKETS AS THEY ARE RIGHT NOW IN VIRTUALLY ALL OF THE INTEREST

RATE FUTURES CONTRACTS. IN BLACK AND WHITE (ACTUALLY RED AND GREEN ON THE

CHARTS BELOW), THEY ARE MONSTOUSLY SHORT UNITED STATES TREASURIES, IN

MINDBOGGLINGLY RECORD NUMBERS, MEANING THAT THEIR BET IS THAT NOTE AND BOND

YIELDS/RATES WILL BE GOING HIGHER.

I AM

TAKING THE OTHER SIDE. I BELIEVE THAT THE 5 YEAR NOTES…AND THE TEN YEAR

NOTES…AND THE TREASURY BONDS…ARE ALL SCREAMING, SCREAMING BUYS.

I HOPE you can decipher

what these next four charts are saying…

TWO YEAR

NOTES

FIVE

YEAR NOTES

TEN YEAR

NOTES

LONG TERM TREASURY BONDS

At a minimum, with all of these markets having been

consolidating for a LONG time, some sort of

truly directional move is very much overdue…

Aside from my STATISTICAL observation that EVERYBODY is

short these markets, I’ll also state that anyone who wants to believe all

the horse manure about US Treasuries no longer being INTERNATIONALLY

REGARDED as the safest and most widely held fixed income paper on the

planet, or no longer representing THE best safe haven paper asset there is,

or no longer an alternative to stocks when they “fall out of favor” (it’s

coming!), or no longer are the PRIMARY fixed income instrument by held by

just about every pension fund, bank and insurance company in the USA?

Anyone who believes ANY of that is making a big mistake. US TREASURY BONDS ARE THE

GLOBAL GOLD STANDARD FOR FIXED INCOME…AND WHEN YOU CAN BUY THEM AT A

ROUGHLY 40% DISCOUNT TO WHERE THEY WERE 5 YEARS AGO, THAT’S WHAT YOU DO.

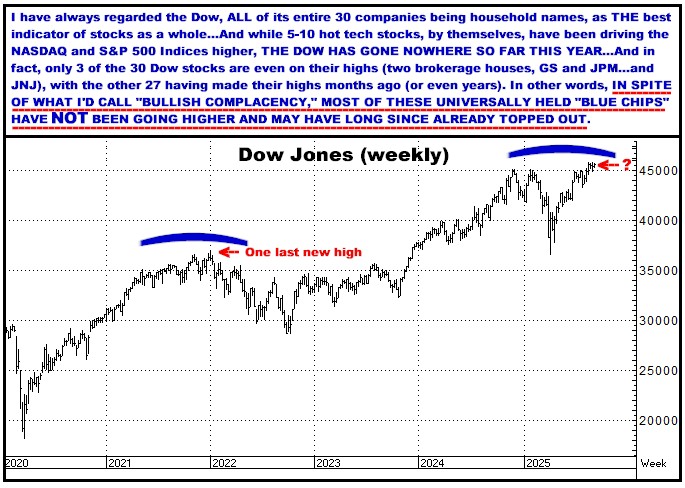

I won’t belabor it but I CONTINUE TO BELIEVE THAT EVERYBODY IS BASICALLY CONTENTEDLY LONG

EVERYTHING…HOT STOCKS, CRYPTO, PRECIOUS METALS, COMMODITIES---TO AN

EXTENT THAT I’D CALL IT “COMPLACENTLY BULLISH”---And

in this investing MOB PSYCHOLOGY GAME,

THAT SORT OF FAIRLY UNANIMOUS “BLASÉ” BULLISH ATTITUDE USUALLY LEADS TO AN

ALWAYS TOTALLY UNEXPECTED “CRAP OUT.” So yeah, I remain of the opinion that big sell offs

are coming in all of those areas…And that the market “nobody” is in, US

Treasuries, are going up from here…and BIG.

WHY SELL STOCKS HERE?

Very briefly, I basically think the economy is in

serious trouble, mostly as a function of the policies and actions of Herr

Trump’s disassembling just about everything there is in the country:

Cutting services, killing jobs, killing entire departments, killing crop

prices, scaring cheap labor (NECESSARY to any number of industries) into

hiding or running out of the country, destroying just about EVERY

diplomatic relationship we’ve had with our longstanding Allies, and then

the moronically SENSELESS Tariff Thing, which in NO way is a positive for

domestic and internationally trade (including all the threats, extremes,

and of course, the abrupt reversals)…has left the CEO’s of this country’s

biggest companies in shock…paralyzed because nobody knows what’s coming…while

at the same time, the average consumer is choking on high prices at the

grocery store and everything else they buy…and this is with the tariff’s

effects JUST beginning to kick in, whether it’s at Walmart, Wendy’s, Home

Depot or anywhere else…I could go on and on in great detail but I’ll just

leave it at this: Paralyzed CEO’s, and business people at any level, is NOT

conducive to growth. Nor is it conducive to spending when consumers ARE

choking on prices in every aspect of their lives. Nor are the very REAL job

losses (that Trump delusionally denies) indicative of growth. And finally,

it belies an absolutely total ignorance of history to suppose that SENDING

THE ARMY INTO THE STREETS is at all a good thing in a democratic economy.

And no, I DON’T know where everything is headed…but I

CAN’T HELP BUT THINK THAT ANY INVESTMENT IN STOCKS, CRYPTO OR PRECIOUS

METALS HERE COULD BE SERIOUSLY UNDERWATER 3-6 MONTHS FROM NOW.

GETTING BACK TO THE REAL REASON FOR THIS

NEWSLETTER…BUYING THE INTEREST RATE MARKETS…

Take another look at those Commitments of Traders and

Open Interest charts above…and be fully aware of just how historically, and

incredibly short, the Speculative Funds are…And then note on the next chart

that they MUST already be showing losses…pretty much across the board.

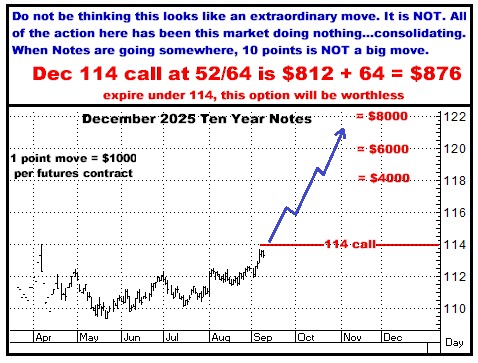

Here’s where I am taking

positions…in the two contracts that will move the biggest…I’d say do both,

or either one. It doesn’t matter…JUST DO THIS…when “nobody else” is…

Hell of a trade I

think…Last thought would be to remind you that there ARE two major paper

investment instruments. One is STOCKS. The other is BONDS…They BOTH have

their periodic days in the sun. And for as long as I’ve been doing this

business, when everybody loves one of them, and “hates” the other…IS when

you jump on the “other.”

Lots of ways to do

this…And I have to add that these options look as cheap as I have ever seen

them in the Treasury market.

Thanks if you read all this…and if you did, and you “get

it,” DO call and do something with it.

Thanks,

Bill

770-425-7241

866-578-1001

All

option prices in this newsletter include all fees and commissions. All

charts, unless otherwise noted, are by Aspen Graphics and CRB.

FUTURES

TRADING IS NOT FOR EVERYONE. THE RISK OF LOSS IN TRADING CAN BE

SUBSTANTIAL. THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE

FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PAST PERFORMANCE IS NOT

INDICATIVE OF FUTURE RESULTS. THERE IS NO GUARANTEE YOUR TRADING EXPERIENCE

WILL BE SIMILAR TO PAST PERFORMANCE.

The author of this piece currently trades for his own

account and has a financial interest in the following derivative products

mentioned within: Notes and Bonds, Feeder Cattle and Live Cattle

|