|

Main Page

| Philosophy

| Current

Recommendations | Newsletter Archives

Contact Us

August 8, 2025

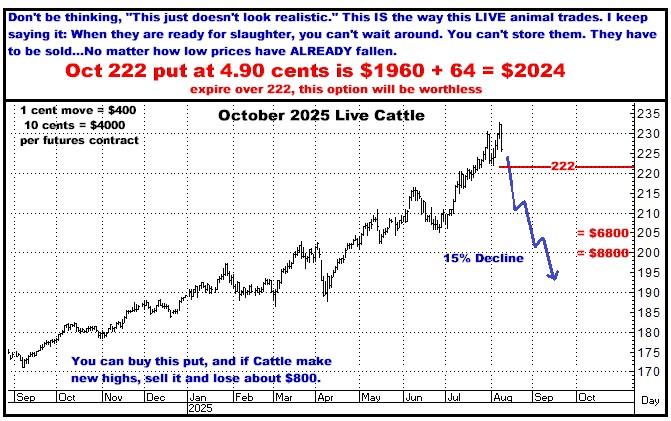

A VERY BEARISH SIGNAL?

Biggest Down Day in Feeders in YEARS

Yesterday, Cattle futures closed into new highs on the

back of Trump’s newly initiated 50% tariff on Beef imports from

Brazil…taking the total tariff for beef entering the USA up to 76%. With

our Cattle herd being at 75 year lows…and beef supplies already tight…the

idea of basically cancelling further Beef imports from Brazil was therefore

interpreted by the trading masses as being unquestionably bullish for

Cattle prices, thus resulting in New All-Time Highs for both Live

Cattle and Feeder Cattle…WHICH I CAN ONLY REGARD AS A CLASSIC FUTURES

MARKET EVENT…THAT BEING PURPORTEDLY “BULLISH” NEWS COMING AT THE VERY TOP OF A BULL MARKET.

As I have often stated, Bull markets do NOT end with

bearish news…Quite the contrary, they FREQUENTLY end with some newsy

addition to the EXTREMELY WELL KNOWN BULL MARKET STORY that implies, “Sure ain’t stopping here!”, AFTER WHICH THEY OFTEN DO, AND

YEAH, LIKE I’VE SAID OVER AND OVER AND OVER…”REVERSE OUT OF NOWHERE AND

THEN JUST GO STRAIGHT ASS DOWN!”

ON ZERO NEWS TODAY, FEEDER

CATTLE CLOSED DOWN THEIR DAILY TRADING LIMIT…9.25 CENTS OR $4625 PER

FUTURES CONTRACT…WITH LIVE CATTLE DOWN 6.25 CENTS OR $2500 PER CONTRACT.

Limit down off nothing? Is this it? Has the top tick been made?...I

don’t know for sure but I DO know that prices for these animals have

gotten more STUPID than just about anything I have ever seen in this

business…And I DO know that the Cattle contracts DO have a

tendency, as I’ve repeated ad nauseum, to REVERSE THEIR BULL MARKETS,

LITERALLY, FROM ONE DAY TO THE NEXT…SO I LOUDLY CONTINUE TO RECOMMEND GETTING SHORT BOTH OF

THESE MARKETS…N-O-W.

Don’t be thinking, “I’ll

wait for a bounce,” or “I want to be sure,” or “He’s been wrong about

this.” If you are ever inclined to short anything (some people never do),

and think this makes sense, DON’T WAIT FOR SOME PERFECT MOMENT. Just

contact me and we’ll figure out what works for you.

FEEDER CATTLE

I want to being both Feeders and Live Cattle…But you can

pick either one…Feeders are more expense but move bigger…Live Cattle are

cheaper bout the leverage actually is about the same.

LIVE CATTLE

SOYBEANS

Nobody I personally know wants to take the short side

here…I CONTINUE TO THINK WE HAVE A LONG AND NASTY DROP DEAD AHEAD. For

sure, there are tons of disappointed analysts, traders and farmers

(especially) out there, but, “Get Short here? NO

WAY!”

CORN

Same story here…ANY sign of an uptick and everybody

wants to get long…There are still MASSIVE sales to come from the farmer’s

old crop bins…and new crop.

Contact me if you want to talk about any of this…I have

my hot and cold streaks…and the whole GD Cattle thing has been a drag for

quite some time…But I DO think the odds are through the roof that this is

about to change…

Thanks…Get ON this.

Bill

770-425-7241

866-578-1001

All

option prices in this newsletter include all fees and commissions. All

charts, unless otherwise noted, are by Aspen Graphics and CRB.

FUTURES

TRADING IS NOT FOR EVERYONE. THE RISK OF LOSS IN TRADING CAN BE

SUBSTANTIAL. THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE

FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PAST PERFORMANCE IS NOT

INDICATIVE OF FUTURE RESULTS. THERE IS NO GUARANTEE YOUR TRADING EXPERIENCE

WILL BE SIMILAR TO PAST PERFORMANCE.

The author of this piece currently trades for his own

account and has a financial interest in the following derivative products

mentioned within: Feeder Cattle, Live Cattle, Corn, Soybeans

|