|

Main Page

| Philosophy

| Current

Recommendations | Newsletter Archives

Contact Us

August 7, 2025

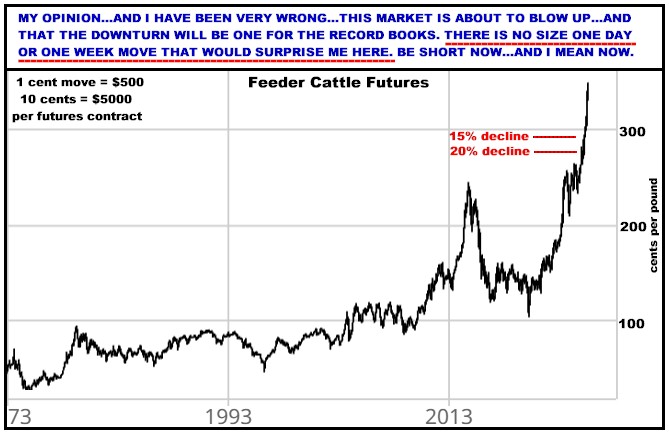

MY GUESS IS THERE ARE “NO SHORTS LEFT,”

WHICH MEANS IT’S TIME TO DO EXACTLY THAT…

I can only say that I have never before seen anything

like the magnitude of the move we’ve seen in Feeder Cattle…and more importantly the magnitude of the

speculative long position that has been built there…such that I look

for the inevitable…and OVERNIGHT….reversal that IS coming here to possibly be the biggest and most violent

downturn that has ever happened in the futures markets.

Again…I have never seen anything like this…

All

of those longs DO have to exit at some point, as SELLERS. And when they do,

you can pretty much say there will be NOWHERE NEAR ENOUGH BUYERS to take

the other side...which IS the perfect storm (a vacuum) for CRASHING more

straight down than potentially anything in the history of futures trading.

SPEC TRADERS ARE MASSIVELY LONG...AND THERE IS NOT A BULL MARKET IN HISTORY

THAT DIDN'T REVERSE...BASICALLY AS A FUNCTION OF EVERYBODY GETTING OUT

Feeders made new highs today, and yes that means I have

still been wrong here…But I honestly believe that if you are NOT already

there when it starts, it will feel impossible to find a place to make an

entry…that this market could do something like close up as it did today…and

off no apparent news, open crazy lower the next morning and be limit down

(9.25 cents or $4625 per futures contract) in no time at all. And no, maybe

that’s not the way it happens, but my point is, AS THERE ARE JUST WAY TOO MANY SPECS WHO ARE LONG, I SERIOUSLY

DOUBT THAT THIS MARKET IS GOING TO JUST START DOWN WITH SOME SORT OF QUIET

SLIDE…

So yeah…I have been wrong…but I am still beating this

drum and looking for fools like myself to get

short HERE…

Have posted this before…Just to remind myself…and

you…THAT WHEN THEY TURN, THEY DO GO DOWN HARD AND FAST…

Feeder Cattle Declines since 1974

|

Year

|

Size of

Decline

|

Timeframe

|

|

1974

|

36%

|

2

months

|

|

1974

|

30%

|

2

months

|

|

1975

|

22%

|

6

weeks

|

|

1976

|

19%

|

10

weeks

|

|

1976

|

21%

|

5

weeks

|

|

1977

|

16%

|

7

weeks

|

|

1978

|

17%

|

1

month

|

|

1979

|

20%

|

7

weeks

|

|

1980

|

24%

|

6

weeks

|

|

1981

|

21%

|

5

months

|

|

1981

|

16%

|

3

months

|

|

1982

|

17%

|

7

weeks

|

|

1985

|

14%

|

11

weeks

|

|

1985

|

16%

|

2

months

|

|

1986

|

20%

|

3

months

|

|

1996

|

19%

|

6

weeks

|

|

1998

|

16%

|

3

months

|

|

2002

|

15%

|

10

weeks

|

|

2004

|

25%

|

1

month

|

|

2006

|

18%

|

9

weeks

|

|

2008

|

17%

|

4

months

|

|

2008

|

15%

|

9

weeks

|

|

2012

|

17%

|

6

weeks

|

|

2013

|

17%

|

4

months

|

|

2015

|

17%

|

9

weeks

|

|

2015

|

20%

|

3

months

|

|

2016

|

22%

|

3

months

|

|

2018

|

15%

|

5

weeks

|

|

2019

|

17%

|

5

weeks

|

|

2020

|

24%

|

6

weeks

|

|

2024

|

21%

|

7

weeks

|

|

Avg

|

18.8%

|

8.5

Weeks

|

Your call…

Thanks,

Bill

770-425-7241

866-578-1001

All

option prices in this newsletter include all fees and commissions. All

charts, unless otherwise noted, are by Aspen Graphics and CRB.

FUTURES

TRADING IS NOT FOR EVERYONE. THE RISK OF LOSS IN TRADING CAN BE

SUBSTANTIAL. THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE

FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PAST PERFORMANCE IS NOT

INDICATIVE OF FUTURE RESULTS. THERE IS NO GUARANTEE YOUR TRADING EXPERIENCE

WILL BE SIMILAR TO PAST PERFORMANCE.

The author of this piece currently trades for his own

account and has a financial interest in the following derivative products

mentioned within: Feeder Cattle

|