|

Main Page

| Philosophy

| Current

Recommendations | Newsletter Archives

Contact Us

July 31, 2025

Tariffs are Bearish

We KNOW that the overwhelming majority (70-80%) of

trading in futures today is done by computerized programs (algorithms and

hedge funds) that are basically feeding waves of money into and out of the

markets…and quite often those funds are headed in one direction, with

allocations being made in that same direction, across a number of markets.

The

five market charts below are not identical, but they ARE very much the

same, and most likely have been collectively influenced SHARPLY HIGHER by

the type of macro market programs I referenced above…perhaps

irrespective of whether or not any of them DO actually any supposed

fundamental basis for having the extreme “values” given to them by the

futures markets…IT’S ALL JUST MONEY FLOW.

Yesterday, Copper

had what was one of the single largest trading days in the history of

commodity trading, dropping over 20% in 1 hour following Trump’s Brazilian

tariff announcement. And wasting no words, I think

it is imminently possible that the same TOTALLY UNEXPECTED fate of Copper… and Silver, Platinum, yesterday & today as

well…is what comes next in Cattle…OUT OF NOWHERE…AS THAT IS THE WAY IT SEEMINGLY ALWAYS HAPPENS IN FUTURES…

If you comparatively trace the dips, rallies, turning points and

sideways moves here, it should be visually quite obvious that funds ARE

moving in tandem…

IT IS MY OPINION THAT TARIFFS ARE IN NO WAY

CONDUCIVE TO PROMOTING ECONOMIC ACTIVITY…IN FACT, BY THEIR NATURE THEY ARE

INHERENTLY RESTRICTIVE…AND WHEN THEY ARE BEING THROWN

AROUND IN EXTREME PERCENTAGES, AND THEN WITHDRAWN, AND THEN IMPLEMENTED,

AND THEN CHANGED AGAIN, THEY ARE NOTHING BUT POTENTIALLY DISRUPTIVE AND

DESTRUCTIVE ON TOO MANY VARIED LEVELS TO ADDRESS HERE…AND, I BELIEVE, WILL

EVENTUALLY (OR FAIRLY IMMEDIATELY ) LEAD TO LARGE, LENGTHY DOWNTURNS IN ANY

NUMBER OF MARKETS…

The truth is, I see the distinct

possibility of another Farm Crisis similar to the mid-80’s could be on the

horizon…where prices for Crops AND Livestock go to devastatingly low

levels.

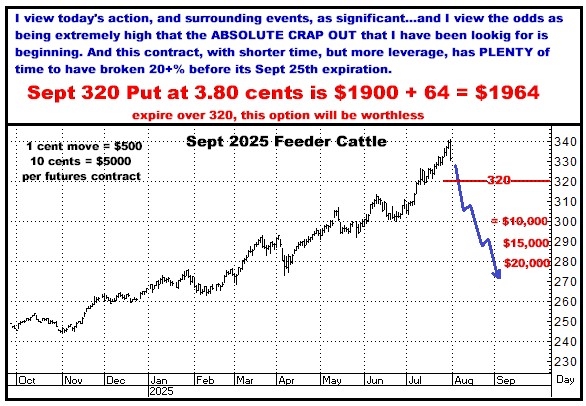

AND SO YEAH…AGAIN…THE CATTLE MARKET, WHICH

WAS SHARPLY

LOWER TODAY…ON ZERO NEWS, IS AT THE TOP OF MY LIST AS AN IMMEDIATE AND

MAJOR, MAJOR SHORT…

Here’s another option possibility…

As always, I recommend being in both the

Feeders and the Live Cattle contracts…They do generally move together, so

you can pick one if you want, but I never know which will be biggest…

Important

thing is: We DO now have action that suggests SOMETHING might be getting

started on the downside, and with a market that is this unbelievably

extended, the possibly of an initial monster move down IS high…so what you

don’t do, or so say I, is decide to “see what happens.”

BEEN WRONG AND LOSING MONEY… BUT WILL NOT

BE OUT…AS I DON’T THINK IT EVER GETS ANY BIGGER THAN THIS.

New lows again in Soybeans today.

I still strongly recommend being Short both Corn and Soybeans.

Call me.

Bill

770-425-7241

866-578-1001

All

option prices in this newsletter include all fees and commissions. All

charts, unless otherwise noted, are by Aspen Graphics and CRB.

FUTURES

TRADING IS NOT FOR EVERYONE. THE RISK OF LOSS IN TRADING CAN BE

SUBSTANTIAL. THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE

FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PAST PERFORMANCE IS NOT

INDICATIVE OF FUTURE RESULTS. THERE IS NO GUARANTEE YOUR TRADING EXPERIENCE

WILL BE SIMILAR TO PAST PERFORMANCE.

The author of this piece currently trades for his own

account and has a financial interest in the following derivative products

mentioned within: Feeder Cattle, Live Cattle, Corn, Soybeans

|