|

Main Page

| Philosophy

| Current

Recommendations | Newsletter Archives

Contact Us

May 31, 2025

JUST BECAUSE THE WHITE HOUSE WANTS STOCKS TO GO

HIGHER

DOES NOT MEAN THAN THEY WILL

JUST BECAUSE COMPANIES ARE MAKING MONEY

ALSO DOES NOT MEAN THAT STOCKS WILL GO HIGHER…

I VIEW THE RECENT 2 MONTH RALLY

AS A FINAL OPPORTUNITY TO SELL…

Last fall I began to express an opinion that, “EVERYBODY

IS LONG EVERYTHING…Stocks (chips, NVIDA and AI in particular), Gold,

Crypto, etc.”, that in essence, “EVERYBODY was IN,” which, in this giant

mob psychology investment game, suggested to me that the next BIG move

would be down…And this DID become the case in Stocks and Crypto…but

ultimately, their sell offs were followed by fairly stout recoveries, with

Bitcoin even making it all the way back to its old high…while Gold did keep

climbing into April before making what I believe will prove to be its high

for many years to come…Nevertheless, my current view is, that if

anything, EVERYBODY IS EVEN MORE LONG THAN THEY WERE BEFORE…AND I CONTINUE

TO RECOMMEND BEING SHORT ALL OF THESE MARKETS.

Aside from my belief that Trump’s scorched earth

approach to economics and world trade will have disastrous consequences (It

is HIGHLY significant that a recent survey showed that America’s CEO’s now

have the lowest confidence in 50 years), I find it astounding that

during the stock market decline and ensuing rally, individual investors

(the public) were actually buying stocks like never before…as is reflected

by this news excerpt from April 4th, the day after Liberation

Day when the Dow had one of its biggest down days ever:

”Individual investors (yesterday) bought stocks and ETFs at a

record pace. Individuals

made $4.7 billion worth of net equity purchases on April 3,

meaning value of shares they bought outpaced the amount they sold by $4.7

billion. This is the highest daily inflow

over the past decade…Retail investors' purchases were

nearly evenly split between single stocks ($2.3 billion) and ETFs ($2.4

billion), with Nvidia

and S&P 500 ETFs (SPY) among the top assets acquired.”

And then there was this (at last week’s top tick since

the rally began):

“Retail

investors on May

19 plowed $5.1 billion into US stocks, according to data

from JPMorgan Chase. That’s the

largest daily inflow into stocks from retail investors on record since data

collection began in 2015.”

In other words, in this investment GAME, in which 62% of

Americans own stocks, and are probably now more long than they have ever

been, not only have they been hanging on to what they already owned, but

they have actually even been BUYING MORE in the face of an economy that is

clearly endangered by the absurdity of 150% tariff threats, job

liquidations, policy flipflopping, etc.…And yes, they have been rewarded

(so far), but I’d

offer that the last 30-40 days have NOTHING to do with where the market

will be 3-6 months from now, and it is my guess that by year’s end,

individual investors, who DO have an endless history of periodically

getting “reamed” by Wall Street’s Banks and Brokerages, WILL find

themselves having lost massively on just about everything they own, or have

bought, up here at the market’s all-time highs.

On a specific note, it’s been a long time since I’ve

seen one company, which was relatively unknown to the public just 2 years

ago, so dominate the headlines…almost to the extent that New York and all

the talking heads are equating its performance to what the whole damn stock

market is going to do…and that is Nvidia…With that in mind, I’d say that

ANY time any one name becomes so popular that it’s seemingly 90% of the

financial news every day, it’s quite possible that, “everybody who would

ever buy it, already has done so,” meaning that all the hoopla and “good

earnings” in the world won’t be pushing it higher. And so when I look

back at that May 19th “record daily inflow” excerpt above, noting “Nvidia and

S&P 500 ETFs (SPY) among the top assets acquired,” all I can think

is…one more time…EVERYBODY IS ALREADY IN.

MY RECOMMENDATION IS TO SHORT ANY, OR ALL THREE, OF THE

STOCK INDEX FUTURES SHOWN ABOVE...WITH MY MINIMAL OBJECTIVES BEING NEW LOWS

FOR THE YEAR IN EACH OF THEM.

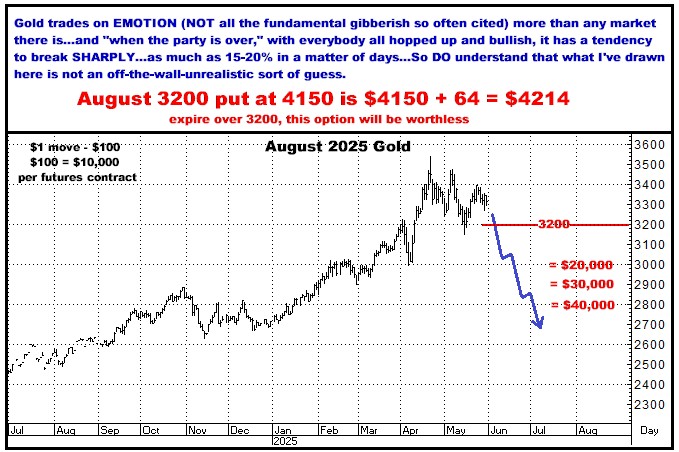

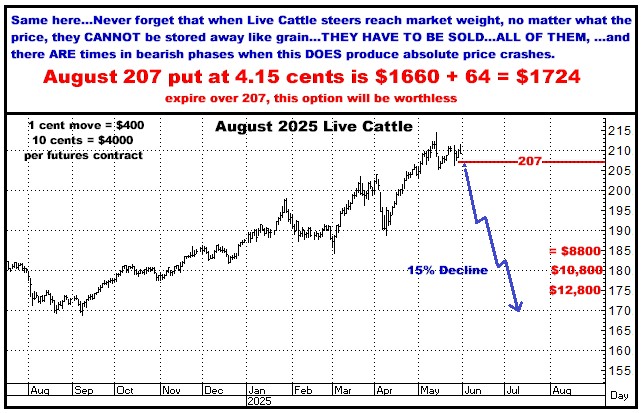

GET SHORT GOLD

THE MARKET

TO BUY?

US TREASURY BONDS

Of late, I note that maybe 98 out of

every 100 Wall Street’s genius “strategists” are squawking about “too much

US debt,” which is the same bearish argument I periodically heard from them

for 40 years…from the Treasury market lows in 1980 until the all-time high

in 2020…Beyond that, be assured that all of the recent chatter that, “The

world has lost confidence in the USA and nobody is going to want our

Bonds,” is absolute hogwash. Aside from the fact that our 30 Year Treasury

has the second highest government backed yield on the planet, UNITED

STATES TREASURY PAPER IS STILL INTERNATIONALLY REGARDED AS THE SAFEST

SOVEREIGN DEBT THERE IS…AND FACT BE KNOWN, EVERY TIME WE HAVE A TREASURY

AUCTION, FIXED INCOME BUYERS LINE UP TO BID

ON IT. PERIOD.

All that being said, in the paper investment world, I’d

remind you that there ARE two major instruments that are traded in the

billions every single day…Stocks…and BONDS. Neither is going to

disappear…and funds are CONSTANTLY flowing in and out of both of them as

these two asset classes fluctuate in value…and quite naturally, there ARE times when their

values, relative to each other, DO reach opposite extremes…and that, I

firmly believe, is where we are now…that STOCKS ARE

EXTREMELY OVERVALUED RELATIVE TO BONDS…AND IN THE MOST BASIC SENSE OF, “BUY

LOW, SELL HIGH,” RIGHT NOW IS WHEN YOU SELL STOCKS…AND BUY BONDS.

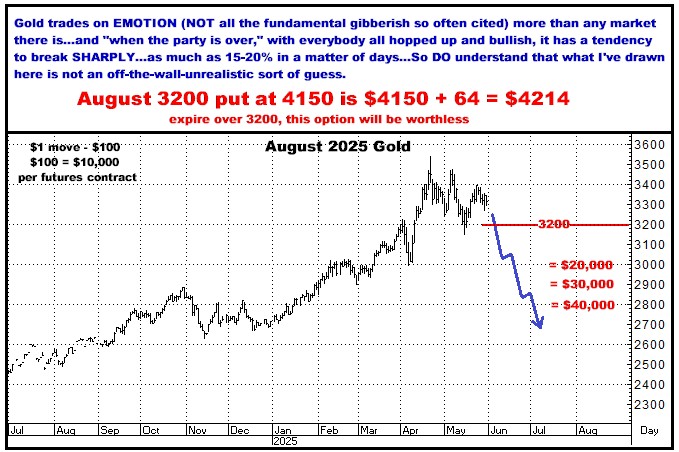

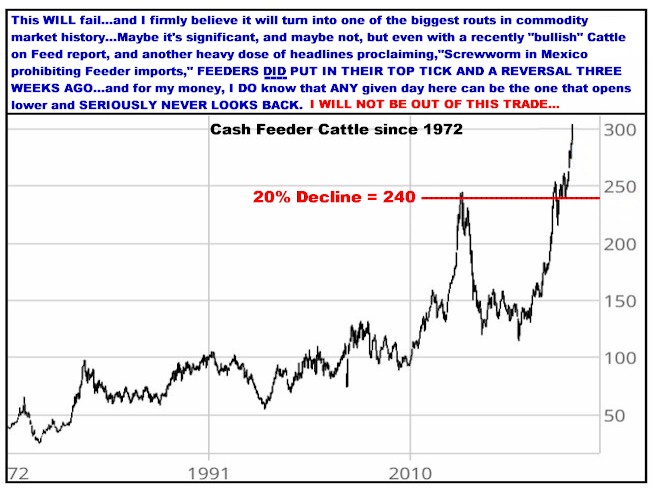

Still Short Cattle

And yeah, this idea has beaten me to death…and I’ve repeated myself

over and over…but I do not lose sight of what the 50 years of history

indicate…that this market DOES go from bullish to bearish, virtually

overnight on NO specific news event whatsoever…and when it does, the

collapses ARE typically 20-25% within 2-3 months’ time…And with a

move like that meaning something like 60-70 cents, or $30,000+ per futures

contract, I WILL NOT BE OUT OF THIS TRADE…ESPECIALLY WHEN, LIKE RIGHT NOW,

WE DO HAVE EVIDENCE OF A TOP TICK HAVING BEEN MADE…And yes, I have made

that same observation before, and been wrong, BUT that does not mean I have

it wrong again…

One

more time…I will not be out of this as I KNOW, that literally from one

trading day to the next, this market can suddenly be down 8-10 cents and

rapidly on its way.

Still Recommend

Short Corn and Soybeans

My impression is that the whole ag world is convinced

that bottoms have been made in both Corn and Soybeans. With massive crops

are coming in both hemispheres, bullish farmers STILL hold tons of both

crops from last fall (that DO represent a LOT of future selling)…and

the backdrop of the destructive tariff situation, I SEE ANOTHER NEW LEG

DOWN IMMEDIATELY AHEAD AS HEAVY SELLING COMES FROM EVERYWHERE.

Still Recommend LONG COTTON

Counterintuitively, Cotton often moves opposite

the other major row crops…and I continue to see Cotton as having made a long term bottom. I still believe the July

contract could have a big surge heading into expiration

but our July Calls now have only 14 days to expiration, and I am now moving out in to

the December contract…where I regard the calls as being dirt, dirt cheap

relative to the fact that Cotton bull moves are typically no less than 30

cents in size.

Have Exited All Long Canadian Dollar Positions

I think that’s enough for

one weekend…Thanks if you actually waded through all this…And I do

URGE you to NOT ignore the opinions in Cattle, Corn and Soybeans as they

all DO look primed for big moves…obviously especially in the Cattle puts,

which aren’t cheap (but that, I think, is because of the enormous move they

are about to make). As for Bonds, Gold and the Stock Indices, I

definitely see them as fantastic big potential trades…but 45 years in this

chair has taught me that very few people seemingly EVER want to Short Gold,

or the Stock Indices…nor do they ever want to be Long Bonds (THE contrary

opinion market), even on those occasions when their 40 year bull market

made for incredible long trades.

Ring me up if you want to

do any of this…or just want to tell me you think I am wrong.

Thanks,

Bill

770-425-7241

866-578-1001

All

option prices in this newsletter include all fees and commissions. All

charts, unless otherwise noted, are by Aspen Graphics and CRB.

FUTURES

TRADING IS NOT FOR EVERYONE. THE RISK OF LOSS IN TRADING CAN BE

SUBSTANTIAL. THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE

FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PAST PERFORMANCE IS NOT

INDICATIVE OF FUTURE RESULTS. THERE IS NO GUARANTEE YOUR TRADING EXPERIENCE

WILL BE SIMILAR TO PAST PERFORMANCE.

The author of this piece currently trades for his own

account and has a financial interest in the following derivative products

mentioned within: All of them

|