|

February 3, 2025

They ARE reversing…

Now 10 cents off their Feeder Highs

Now 8 cents off Live Cattle High

As

I noted last week: When, as it has been for the past 8-10 days in Cattle, ALL

of the news is about the HOT cash market, you’d better lookout. For sure, when

the cash is popping, it makes EVERYBODY in the industry feel good…and blindly

(foolishly) optimistic about the future…but again, and I’ll put it bluntly, THE

CASH MARKET DOES NOT HAVE A GD THING TO DO WITH THE FUTURE…THAT, IF ANYTHING,

ALL IT DOES IT CREATE TRAPS FOR GIDDY BULLS…and more specifically, when the

CASH MARKET DOES BECOME 100% OF THE STORY, IN MY EXPERIENCE IT ALMOST ALWAYS

MEANS, “SELL NOW!”

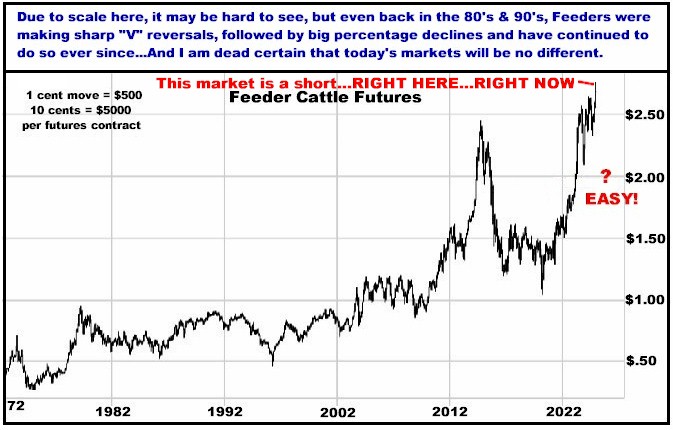

As I have documented many times here, the cattle

market has a 50 year record of making SHARP bullish to bearish turns…and then

almost immediately going relatively straight down…to the extent that if

you DO want to get short, when they present evidence of a reversal, you CANNOT

wait around for a convenient “bounce” to get on . In

other words, you either need to already be there when they turn, or if you’re

not, at the FIRST potential sign of a reversal, YOU GET SHORT POSITIONS

ESTABLISHED.

In

the midst of rip roaring cash news the past two

weeks…AND a purportedly bullish Cattle on Feed Report a week ago…AND a further

bullish Cattle Inventory Report this past Friday (“Smallest Herd since 1952!”),

BOTH LIVE CATTLE AND FEEDER CATTLE CLOSED FRIDAY WITH DOWNSIDE WEEKLY REVERSALS…FOLLOWED

BY SHARPLY LOWER TRADE IN BOTH TODAY.

Is this finally it? I don’t know but I DO know that THE FUTURES MARKET MORE OR LESS IGNORING TWO

CONSECUTIVE BULLISH REPORTS…AND ROARING CASH…CERTAINLY MUST REPRESENT SOME KIND

OF A SIGNAL AS TO WHERE THIS MARKET IS HEADED…

I’M SCREAMING IT. GET SHORT

CATTLE NOW.

Their NORM (see 50 year tables

below) IS to drop between 15%-25%...And

some years have multiple sizeable declines…

Feeder Cattle Declines since

1974

|

Year

|

Size of Decline |

Timeframe |

|

1974 |

36% |

2

months |

|

1974 |

30% |

2

months |

|

1975 |

22% |

6

weeks |

|

1976 |

19% |

10

weeks |

|

1976 |

21% |

5

weeks |

|

1977 |

16% |

7

weeks |

|

1978 |

17% |

1

month |

|

1979 |

20% |

7

weeks |

|

1980 |

24% |

6

weeks |

|

1981 |

21% |

5

months |

|

1981 |

16% |

3

months |

|

1982 |

17% |

7

weeks |

|

1985 |

14% |

11

weeks |

|

1985 |

16% |

2

months |

|

1986 |

20% |

3

months |

|

1996 |

19% |

6

weeks |

|

1998 |

16% |

3

months |

|

2002 |

15% |

10

weeks |

|

2004 |

25% |

1

month |

|

2006 |

18% |

9

weeks |

|

2008 |

17% |

4

months |

|

2008 |

15% |

9

weeks |

|

2012

|

17% |

6

weeks |

|

2013 |

17% |

4

months |

|

2015 |

17% |

9

weeks |

|

2015 |

20% |

3

months |

|

2016 |

22% |

3

months |

|

2018 |

15% |

5

weeks |

|

2019 |

17% |

5

weeks |

|

2020 |

24% |

6

weeks |

|

2024 |

21% |

7

weeks |

|

Avg |

18.8% |

8.5

Weeks |

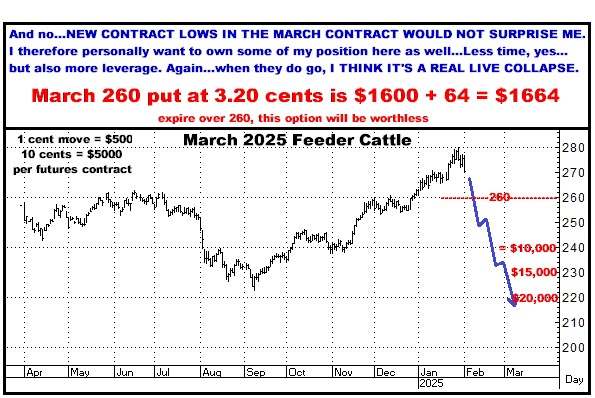

A 20% decline in Feeders from current levels equates to

about 55 cents or $27,500 per futures contract…

Price Declines in Live

Cattle

Prices since 1978

|

Year |

% Decline |

Time Frame |

|

1978 |

16% |

2 mos. |

|

1979 |

26% |

5 mos. |

|

1980 |

12% |

2 mos. |

|

1980 |

20% |

6 mos. |

|

1981 |

18% |

5 mos. |

|

1982 |

26% |

6 mos. |

|

1983 |

16% |

7 mos. |

|

1984 |

14% |

7 mos. |

|

1985 |

25% |

8 mos. |

|

1986 |

18% |

3 mos. |

|

1987 |

9% |

3 mos. |

|

1988 |

16% |

2 mos. |

|

1989 |

12% |

4 mos. |

|

1991 |

22% |

5 mos. |

|

1993 |

18% |

7 mos. |

|

1994 |

22% |

3 mos. |

|

1995 |

20% |

7 mos. |

|

1996 |

21% |

4 mos. |

|

1996 |

14% |

5 mos. |

|

1997 |

16% |

5 mos. |

|

1998 |

16% |

5 mos. |

|

2000 |

13% |

4 mos. |

|

2001 |

26% |

9 mos. |

|

2002 |

19% |

4 mos. |

|

2003 |

33% |

3 mos. |

|

2005 |

17% |

3 mos. |

|

2006 |

19% |

4 mos. |

|

2007 |

17% |

3 mos. |

|

2008 |

18% |

4 mos. |

|

2011 |

22% |

2 mos. |

|

2012 |

13% |

5 mos. |

|

2015 |

29% |

7 mos. |

|

2016 |

30% |

8 mos. |

|

2017 |

28% |

5 mos. |

|

2018 |

16% |

2 mos. |

|

2019 |

24% |

5 mos. |

|

2020 |

23% |

2 mos. |

|

AVG. |

19.5% |

4.6 mos. |

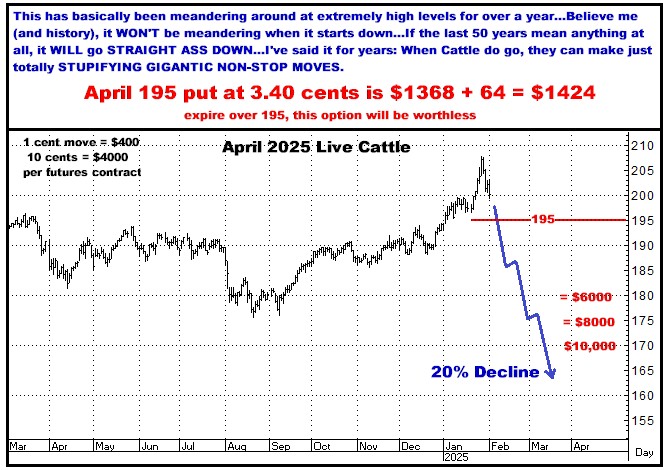

A 20% decline

in Live Cattle from current levels equates to about 40 cents or $16,000 per

futures contract.

Considering the truly stratospheric levels

we’re at, I see ZERO reason to expect anything less than the 50 year average

drops of both markets.

If you think my case makes sense, and have

the stomach for this sort of investment…and the risk capital…I URGE YOU TO

CONTACT ME AND DO SOMETHING WITH IT…N-0-W.

Options

I like here (which may be more expensive tomorrow)

What I've drawn below is not wishful

thinking. Per the histories I've shown you so many times, Feeders do frequently

make their turn and DO go straight down...And DO know that AS Live Cattle

prices weaken, AT ALL, from current levels, EVERY Feeder Cattle owner from up

here will immediately start losing money...which can quickly turn into BIG

money…and NEW FEEDER BUYERS WILL LIKELY THEN BEGIN TO TOTALLY DISAPPEAR...and

believe me, DISAPPEARING BUYERS MEANS CRASHING PRICES.

Been waiting, and waiting, and waiting…But

more so than ever, this looks and feels like it’s here.

It’s big. Maybe I’m dead wrong, which can mean

losing every dollar you spend, but I SEE big MONEY HERE.

Do it. Do SOMETHING while it’s up here…NOT after it’s dropped 8-10% and I’m

breathing fire about getting more…Call me now and get on.

It’s in your court guys. Wish I could…but I

can’t do it for you…

Thanks,

Bill

770-425-7241

866-578-1001

All

option prices in this newsletter include all fees and commissions. All charts,

unless otherwise noted, are by Aspen Graphics and CRB.

FUTURES

TRADING IS NOT FOR EVERYONE. THE RISK OF LOSS IN TRADING CAN BE SUBSTANTIAL.

THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT

OF YOUR FINANCIAL CONDITION. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE

RESULTS. THERE IS NO GUARANTEE YOUR TRADING EXPERIENCE WILL BE SIMILAR TO PAST

PERFORMANCE.

The author of this piece currently trades for his own

account and has a financial interest in the following derivative products

mentioned within: Feeder Cattle, Live Cattle