|

Main Page

| Philosophy

| Current

Recommendations | Newsletter Archives

Contact Us

Research and recommendations by Bill Rhyne

For more info or consultation…

Landline 770-425-7241

Cell 770-366-3070

January 22, 2026

Telling it like it is…or was…

Thanks mostly to

the Cattle markets, 2025 was the worst year I’ve ever experienced in this

business. My short opinion just ate me alive (and some of

you too) as they soared higher and higher, and then worst of all, when an

80 cent (20%, or $40,000 per futures contract) break in Feeders finally

happened over a 7 week period during October and November, I DID NOT TAKE

THE PROFITS OFF THE TABLE…and subsequently watched all that money disappear

into more losses as Cattle rallied straight back up, 60 cents in Feeders,

right into last week, which was just dumb as SHIT. I mean, it’s one thing to be wrong

about the markets, as that IS an unavoidable aspect of trading. But to have

a LOT of money in hand, and then let all of it

basically evaporate is just STUPID…and that is what I was.

Nevertheless, after 45 years in this chair, I do know

that having been wrong does not mean that I will continue to

be so…And the fact is, throughout my career, after the markets have left me

being just dead, dead wrong, has often been when I’ve come up with some of

my very biggest trades. Obviously, there’s no way to know if it will hold

true again, but after substantial “self-flagellation” and research, what

follows are some big picture 2026 observations as

well as recommendations in specific markets that I view as having major

profit potential during the next 3-6 months. I’d also note that I have

definitely not closed my own account J…and that if I recommend

something, I am in it with my own money as well.

THE BIG PICTURE

Sell What’s Hot

Buy What’s Not…

Having been in this business since 1980, I have traded

through more bearish crises and bullish euphoria’s than I can count…which

allows me to feel comfortable in saying that these decades of hard core

experience have provided me with a unique perspective regarding THE NATURE

OF THIS INVESTING GAME...And right

now MY

OBSERVATION IS THAT THERE IS MORE RAMPANT SPECULATION…AND

EVERYTHING-IS-BULLISH FERVOR…THAN I HAVE EVER SEEN IN THE MARKETS. For real, I cannot think of a time…not

even the Dotcom bubble…that even comes close.

You know all the “Top Hits”…AI, Chat GBT, Chips, Robots,

Crypto, Precious Metals, the Mag 7, etc.…Just take your pick of any of

them, or buy them all, and by the media’s reckoning, you’re bound to do

nothing but make money…I mean really…With all of them SO hot, and being

touted via bullish headlines every day, YOU KNOW THAT NEARLY 100% OF THE

INVESTING PUBLIC IS ALREADY IN THESE UNANIMOUS WALL STREET

FAVORITES for as much as they can stand…to the extent that I’d guess

there’s really “nobody” left to buy them…And if that is the case, I

am telling you, what comes next will not be pretty.

This might sound like ancient history…but maybe you’ve

heard of the “Nifty 50,” or the 50 stocks back in the early 70’s that the

brokerage firms were touting as THE 50 companies every investor HAD to have

in their portfolio, the idea being that buying these 50 stocks, at the

Dow’s all time high (then), represented an almost “can’t miss” approach to

investing in the market…Long story short…Wall Street was wrong…The

market topped in December 1972, and went down 46% during the next 20

months, taking the public’s money with it…who probably lost MORE

than that 46%.

So what’s the point?

I firmly believe that today’s “Magnificent 7” is

the “Nifty 50” of the 1970’s, and that, in spite of all of those companies

certainly making tons of money, I’d suggest that every great thing about

their businesses has been 300% priced into their stock “values” by now, and

that the next thing we’re going to see is a major decline. I would

also note, and think you would agree, that the news regarding the

profitability of the Mag 7 for the past 4-5 months has been ongoingly white

hot…BUT…look at what has quietly been happening:

Nvidia -14% decline from its high. At the same price it

was back in August.

Meta – 23% decline from its high.

Amazon – 9% decline from its high. Same price as last

August.

Google – The one exception…At new highs

Tesla – 13% decline from its high. Same price as last

September.

Apple – 13% decline from its high. Same price as

September

Microsoft – 17% decline from its high. Same price as

last June.

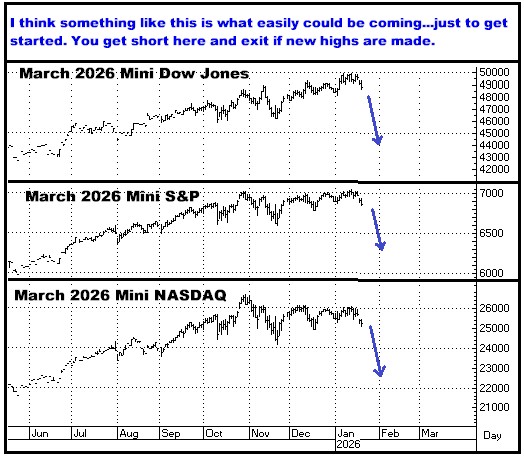

Ok…According to New York’s shills, owning all of these

is supposed to be a layup, but quite honestly, 6 of the 7 (and a number of

other major names) look to me like they are either rolling over and/or have

started protracted declines. And yeah, Wall Street will describe what is

happening as “just a rotation,” but I have heard that story before…And when

I see these LEADERS absolutely NOT leading, and put this together with

what, again, I

can only describe as an atmosphere of RAMPANT SPECULATION, every trading

instinct I have says, “GET SHORT!”, or at a minimum, to

sure as hell not be believing the brokerage house “logic” that these very

real declines are “pullbacks,” or opportunities to buy more. NO WAY.

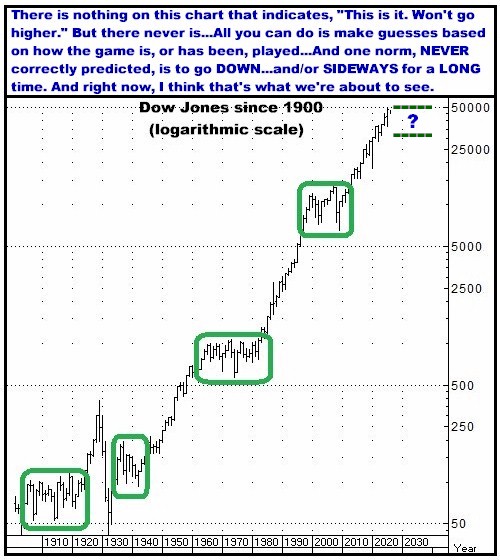

The truth is, I think it is quite possible that we

maybe have reached one of those NORMAL historical periods where the stock

market doesn’t just go up, up and away year after year, but instead does

something like it has done on four occasions during the past century or

so…that being, trading relatively sideways for 10-20 years…putting

together a series of bull and bear markets that DON’T…in this

INVESTING-IN-PIECES-OF-PAPER GAME…allow everybody to just sit there and get

rich while the companies that EVERYBODY loves just keep paying, and paying

and paying. It does NOT work like that. As I’ve said forever, all of these paper market

prices are determined by the mob psychology dynamics of PEOPLE GETTING

IN…AND PEOPLE GETTING OUT (and far more often than not, the OUT being the

general public getting the shaft straight out of NYC).

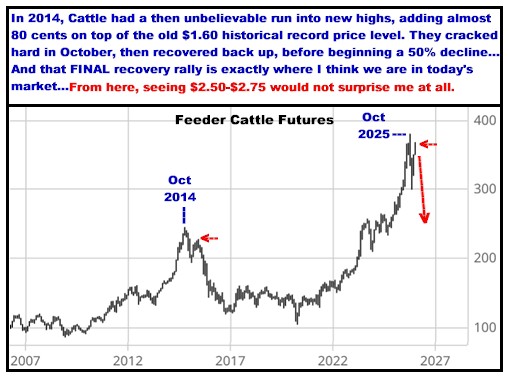

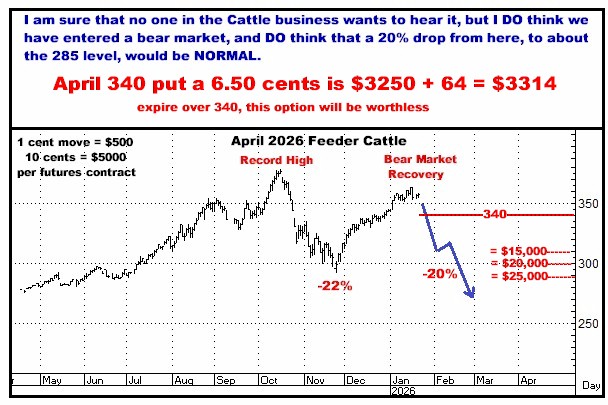

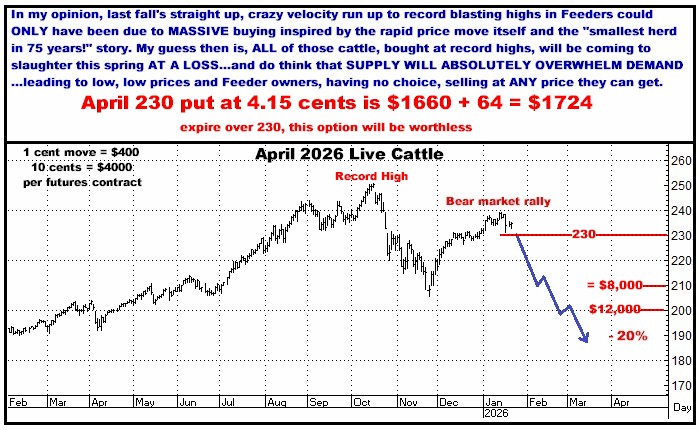

Yes…Still Short Cattle

I still have no doubt that last fall’s rocket shot

to record highs was driven by euphoria and cattlemen PILING in to Feeders

with a “no way to lose -pay ANY price” mentality…And going forward, between

February and May (more or less) that avalanche of buyers will…ALL TOGETHER

NOW…be needing to market (SELL) those steers as they mature into slaughter

ready weights.

When you are at the bottom of an agricultural market,

everybody knows there’s a lot of it, and even though the markets have

obviously priced in this KNOWN fact, the typical trader perspective is,

“How can it possibly go up?” But it DOES…And conversely, there probably

hasn’t been a single top in commodity market history that wasn’t basically

accompanied by something like, “The numbers are the lowest in 75 years, so

how can it possibly go really go down very much?” But that is how

the futures markets work…I firmly believe that the highs, for many years, were made last

fall in the Cattle Complex…and that the recovery we’ve seen since November

has been a classic bear market rally back towards the highs…that might be

failing here, and is about to be followed by a devastating sell off that

will take prices lower than anyone in the cattle business would think

possible as all of those Fed Cattle owners, already losing

money, are forced into selling…AT WHATEVER THE PRICE MIGHT BE.

I CONTINUE TO RECOMMEND BEING SHORT BOTH FEEDER CATTLE

AND LIVE CATTLE…and I do intend to take the profits this if we get

the 20% (70 cents per contract in Feeders, 45 cents in Live) sell off that

has been their bear market NORM going back decades.

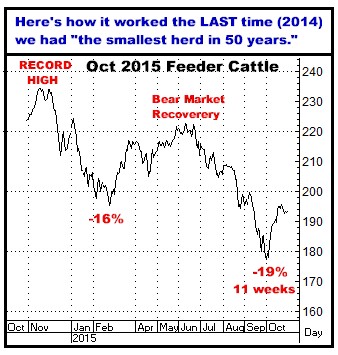

Some then and now…

Believe me...230-240 Feeders at the October 2014 high

was just insane compared to the previous record highs, but even so, at that

top the whole Cattle world had become wildly and resolutely bullish due to

"the smallest herd in 50 years!", which IS the same story that’s

out there today…implying high prices forever…BUT…a year later prices had

dropped by over 40%...and then stayed that way for another 5 years…And I

see no reason for this time around to be any different. I keep saying

it…This IS how the futures markets DO work.

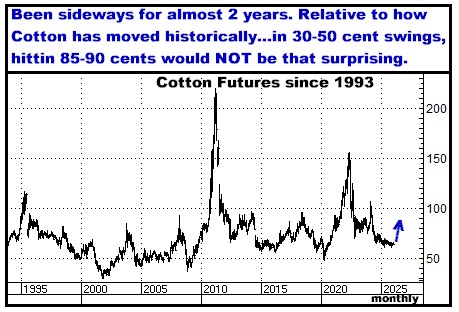

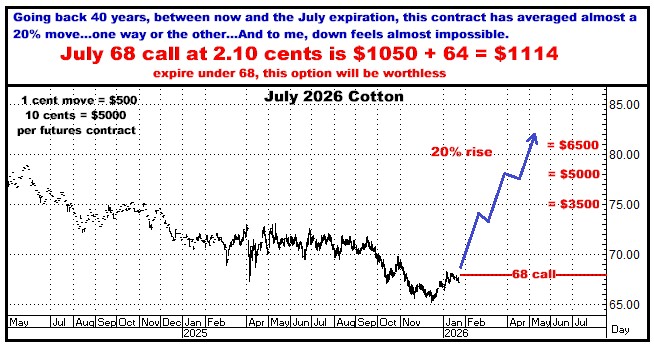

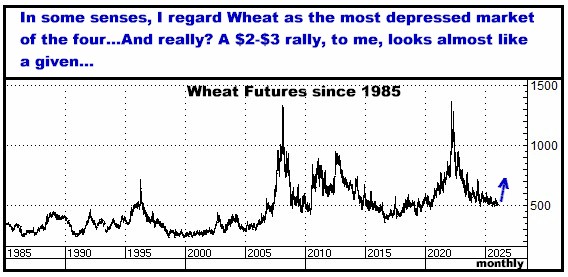

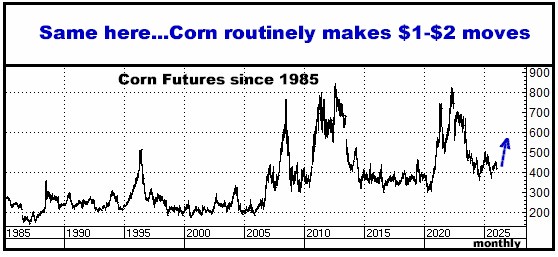

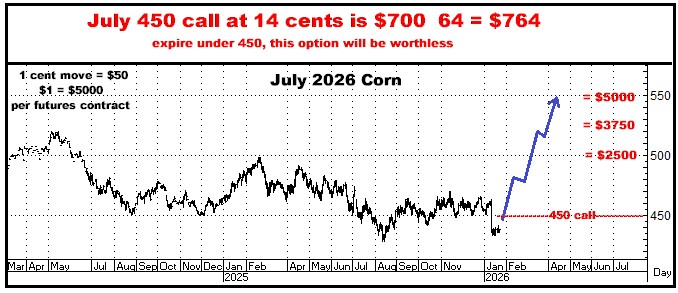

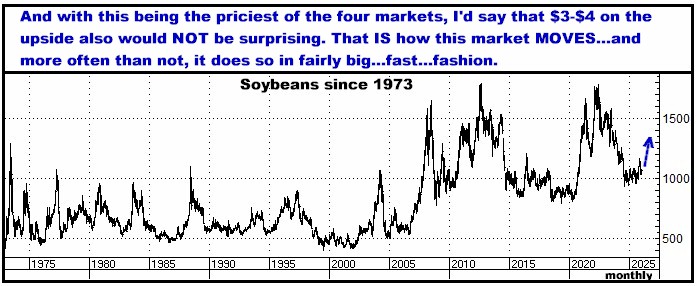

Buy the Row Crops

THE MOST UNDERVALUED ASSET CLASS

In the markets today…

Yep. There are big crops and big supplies everywhere.

But that IS the way it’s been for virtually every commodity market bottom

in history. I don’t care what anybody thinks about what China will do…or

how “expensive” our crops are relative to South America or anywhere else…or

how much acreage will go into any of

them…or what current stocks are relative to history…Plain and simple, you ignore

all the bearish analysis out there (by all of the same people who were

bullish as we went down for the past 3 years) and BUY CALLS IN ALL FOUR

MARKETS, knowing that if just one of them gets going, you

could still possibly make money if the other three just do nothing or

totally go in the tank. Obviously, all four could do nothing, meaning

losing 100% of what you put on the table…But for my money, and my concept

of risk vs reward, I don’t think it gets any better than this…and would

also note, that typically these four markets do have a tendency to move in

unison…and I would not be buying all four if I didn’t think that they will

all be going up from here. I MIGHT BE DEAD WRONG BUT I THINK THIS IS A

GREAT, GREAT BET.

Check out the math yourself and see what YOU think…

BUY COTTON

BUY WHEAT

BUY CORN

BUY SOYBEANS

If you see this in the same way I do, I definitely think

it makes sense to buy all four markets (about $5000) as one unit. Again, if

just one of these gets going, it CAN pretty much cover the total

investment…And as for what happens if they all go, even moderately,

well…just do the math for yourself…And DO know that the targets I’ve shown

here are NOT wild ass expectations. In every case here, what I’m supposing is based on how all of these markets DO move.

Also…Be aware that there is a LOT of time between now

and July…and a LOT that can happen...BEFORE you start seeing any headlines

noting that “the crops have been rallying.” In other words, get ahead of all that and get

on now…especially while all of these calls just look cheap as dirt to me.

Ready to make some money this year…

Contact me if you’re interested.

Thanks,

Bill

770-425-7241

866-578-1001

All option prices in this newsletter

include all fees and commissions. All charts, unless otherwise noted, are

by Aspen Graphics and CRB.

FUTURES TRADING IS NOT FOR EVERYONE. THE

RISK OF LOSS IN TRADING CAN BE SUBSTANTIAL. THEREFORE, CAREFULLY CONSIDER

WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL

CONDITION. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THERE IS

NO GUARANTEE YOUR TRADING EXPERIENCE WILL BE SIMILAR TO PAST PERFORMANCE.

The author of this piece currently trades

for his own account and has a financial interest in the following

derivative products mentioned within: All of them

|